Cake Box (CBOX.L): the UK's leading cake shop chain with multi-bagger potential

A business Warren Buffett would definately like

Hey guys,

This is Alex from Rome Capital! This channel is now laser-focused on the exciting world of special situations and small-to-mid-cap growth companies in the US and Europe. Rome Capital will be serving up this analysis on a regular (or... let's be honest, irregular) basis, so stay tuned!

But before diving into our (groundbreaking, of course) latest research, let’s start with a brain teaser: What are the two thinnest books in the world?

Drumroll for the answer!

One is USA History

The other is UK Cookbook—and no, there's no need to rank them, they’re equally slim… Today, we’re diving into a dark and mysterious topic: British cuisine! Buckle up!

Hold your horses, we're not here to talk about fish and chips just yet. If you don’t like the first joke, here's another one: What’s the one holiday that everyone in the world celebrates every year?

Let me tell you—it’s their own birthday! Well, except for a few unlucky folks who only get to celebrate once every four years… but I’m sure they still find an excuse to grab some cake. Speaking of cake—what’s a birthday without one, right? At least, everywhere I’ve been, cake is a must.

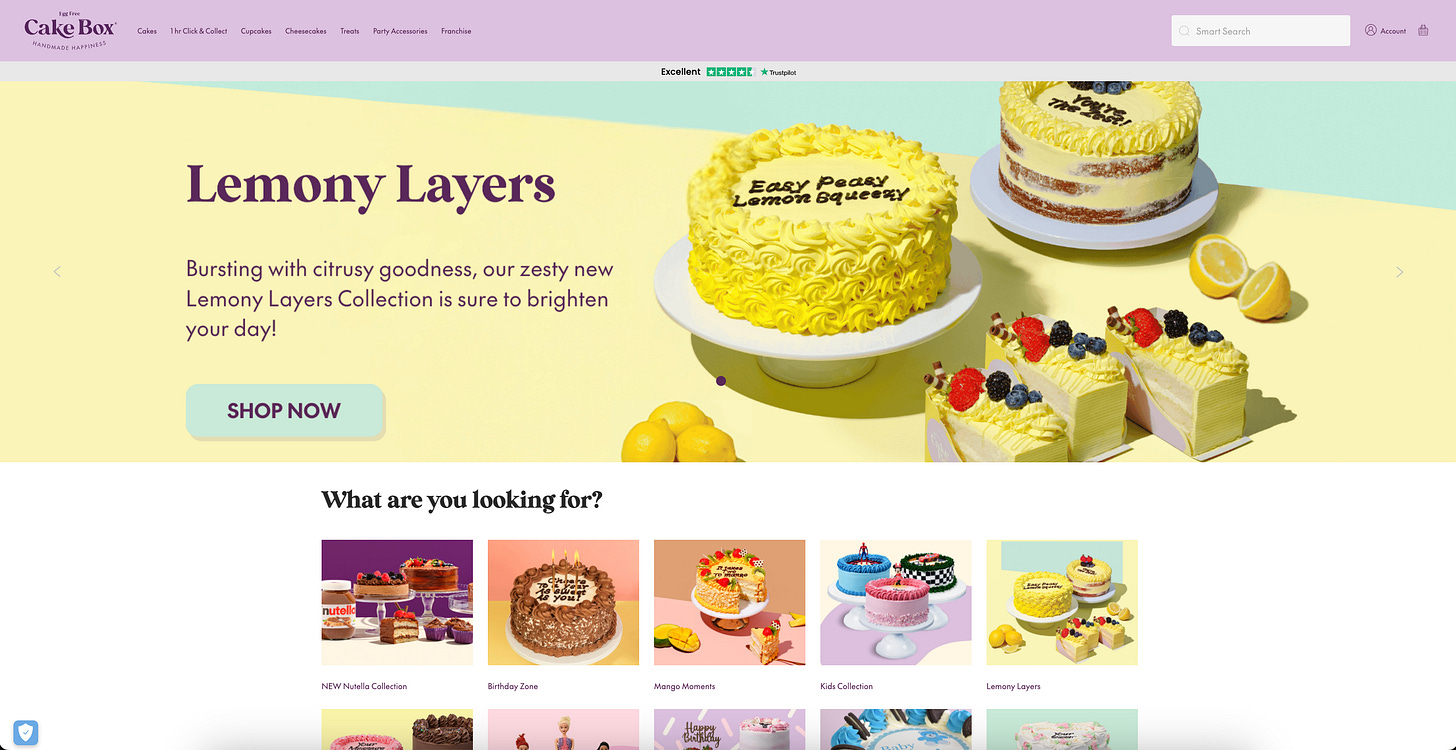

Now, imagine a company becoming the king of cakes in its country. Sounds like a sweet business, right? You get lucky today, as I just happen to have one right here—Cake Box (London Stock Exchange: CBOX):

The undisputed cake leader in the UK- 10 times larger than the runner-up, which means absolute scale and first-mover advantage.

A top-notch asset-light franchise model that generates excellent cash flow.

After two years of heavy investment in centralized operations, they’re nearly done—meaning growth and margin expansion are around the corner.

Plans to double the number of stores in the UK and potential expansion into Europe Continent.

With an attractive valuation and tempting dividend yield, the potential return is 10x!

Well, well, I know you are gentlemen who treat money like dirt. But I bet you’ve got to be tempted for some treats. Hop in and here we go!

I. The Unrivaled Leader

You might have had this nightmare before: your alarm goes off in the morning, you groggily check your phone, and there it is in big, bold letters—“Wife’s Birthday”—and you have zero memory of it!

What’s worse, the nice cake shops in the UK usually take orders 4-7 days in advance. Of course you can get a cake from Tesco and enjoy hearing her complain about how miserable life is during the dinner. What a romance!

My forgetful British gents, let not your heart be troubled, neither let it be afraid. The Gospel has arrived- Cake Box, a lovely celebration cake brand founded in 2008. They can whip up a fresh cake for you in just one hour, and even print a beautiful photo of your wife on top! What if she’s a vegeterian? No problem! The cakes are 100% egg-free. That's right, no eggs in the sponge at all. What’s even better? You can barely tell the difference from ordinary egg-filled cakes—I’ve personally tested it!

So where can you get these amazing cakes? Cake Box already has 225 stores across the UK, and they plan to expand to 300 and even 400! If there isn’t one near you yet, hang in there—it’s coming soon!

II. An Unmatched Business Model

Cake Box’s business model is simple and delicate. They operate three production facilities across the UK, where they bake the sponges and whip up the frosting. Then, they deliver all the necessary ingredients (except for the fruit), packaging, candles, and other supplies to the franchisee-owned stores. Franchisees then decorate the cakes according to the company guidebook and customer requests (like personalized messages or photos). Customers can either pick up their cakes or have them delivered through services like Uber Eats or Deliveroo.

The stores are straightforward, just like cake shops everywhere, with display cases filled with birthday cakes, slices, and cupcakes; and a workshop and storage room in the back. It’s as simple as that.

People celebrate big moments with cakes, therefore you need to be good at everything: great taste, design, and service. Of course it’s always better when the price is great. Cake Box has all of that covered like an all-rounder champion:

Great Price: Cake Box sits right in the sweet spot, with an average spending of £25. As Brits have an average disposable income of £25,000, that’s just a piece of cake.

Great Taste: On a scale of 1 to 10, I’d give it a solid 8. It’s not mind-blowing, but absolutely great enough. The company’s founder, Sukh Chamdal, was a pro chef and never stops innovating. Last year’s hit was the mango collection. And this year Sukh’s pride is the Ferrero Nutella cross-over. Fun fact: Cake Box is the only official cake brand partnered with Nutella!

Great Design: Cake Box knows exactly what it’s about—think of it as the Uniqlo of cakes. It leaves the fancy stuff to the boutique bakers. But don’t be fooled into thinking their cakes are boring! They’ve got some really fun designs, for example the one popular cartoon characters. Plus, they always roll out special editions for holidays, so there’s plenty to keep customers excited.

Great Service: Cake Box is killing it when it comes to service. They’ve got a 4.5-star rating on Trustpilot, which is way above the UK service industry average of 4.1. To give you an idea of how good that is, one month they pulled in £6 million in online sales (that’s over 200,000 orders), and they only had 12 complaints.

Now, let’s talk about their franchise model. If you’re looking to start a business in the UK but don’t have much experience, opening a few Cake Box stores could be a solid choice:

Low Investment: It only takes £150,000–£170,000 to open a Cake Box store. For comparison, Domino’s Pizza costs £350,000, and Subway is around £250,000.

High Return: The average Cake Box store makes £350,000 revenue a year, with cash profits over £60,000, meaning you can recoup your investment in 2–3 years. In comparison, Domino’s takes 3–4 years. And the median store annual revenue of competitor Eggless Cake Shop is only £180,000.

Simple Franchise Model: It’s a one-time investment, with no annual franchise fee. You just buy supplies from the company, and pay a 1.5% marketing fee (a new policy from the past two years, not sure if it’s permanent) plus a 7% service fee for online orders. In this case, franchisees don’t feel they get a haircut by the annual franchise fees most brands charge. Instead, Cake Box gets its fair shares through the sales of supplies every day.

High Success Rate: Since Cake Box started in 2008, only four stores have ever been closed down. Franchisees are pretty keen to expand too—out of 95 franchisees, 47 own multiple stores. That’s a huge success in the franchise world.

Compared to other franchise models, Cake Box is truly top-tier:

Win-Win Partnership: The company provides the brand, tech, and supplies, while franchisees handle production, service, and store management. It’s a clear division of labor, and both sides rely on each other. Profit-sharing is also fair: franchisees pay 45% of their revenue for supplies from the company, and still they keep over 15% net profit. On the other hand, Cake Box earns a 50% gross margin. Both sides win from the growth.

Low Risk of "Under-the-Table" Sales: In businesses like hair salons, franchisees could sell services off the books to dodge franchise fees. The brand can’t control this easily and has to rely on estimates or mystery shoppers, or they just charge flat fees instead, which means they don’t benefit from franchise growth. This often leads to a falling-out. But with Cake Box, it’s much easier: as long as the stores are buying their products from the company, it’s all set.

Low Risk of Franchisees Going Solo: Again like hair salons, the quality depends on the individual stylists, not the brand. Customers follow their favorite stylist, and when a stylist builds up a loyal clientele, they could go solo. With Cake Box, customers come for the brand, and franchisees are dependent on the company for supplies. So the risk of them going independent is practically zero.

Stellar Business Model: The numbers speak for themselves. Cake Box didn’t even raise funds during its 2018 IPO. Since then, revenue has jumped from £12.7 million to £37.8 million, and stores have grown from 91 to 225, and they’ve built two new factories. In the meantime generated £31.89 million in cash flow, paid out £14.11 million in dividends, and still have £6.11 million in net cash, but only spent just £9.08 million on capex. This really highlights their financial strength.

With such a simple and profitable model, you’d think loads of people would try to copy it, right? Of course! In fact, three of the competitors all focus on egg-free cakes just like Cake Box. But Cake Box has never been overtaken and continues to pull ahead. In fact, the scale gap is growing every year.

Source: Rome Capital

That’s thanks to its first-mover advantage, scale, excellent service, and efficiency in opening new stores:

First-Mover Advantage: The best way to understand Cake Box’s lead is to look at its progress over the past few years. While it may seem like the company slowed down on the surface, they’ve actually been sharpening their skills behind the scenes. They’ve revamped the management team, rebuilt their website and ERP system, reshaped their customer service culture, rolled out version 2.0 stores, launched professional advertising strategies, online marketing, a membership program, and a smarter store location strategy. Basically, they’ve transformed from a SME into a public company. Those have laid the groundwork for Cake Box’s next period of rapid growth. While for their competitors, these are lessons they yet to take.

Here’s a comparison of their store design 1.0 (top) vs 2.0 (bottom):

Here’s a comparison of their store interiors: version 1.0 (top) vs. version 2.0 (bottom):

Here’s a comparison of their old website (top) vs. the new website (bottom):

Scale Advantage: Thanks to these investments, the company’s annual management costs have increased by £6 million (Yes, I’m being thankful!). In comparison, we estimate that their strongest competitor, Cake Inn, has an annual revenue of less than £5 million. That’s the gap. Cake Box can use these resources for product innovation, targeted marketing, franchisee support, and partnerships with big brands, creating a positive feedback loop.

For example, the image below shows Cake Box, Cake Inn, and Cake Shop in Wolverhampton, and Cake Box is the only one advertising on Google.

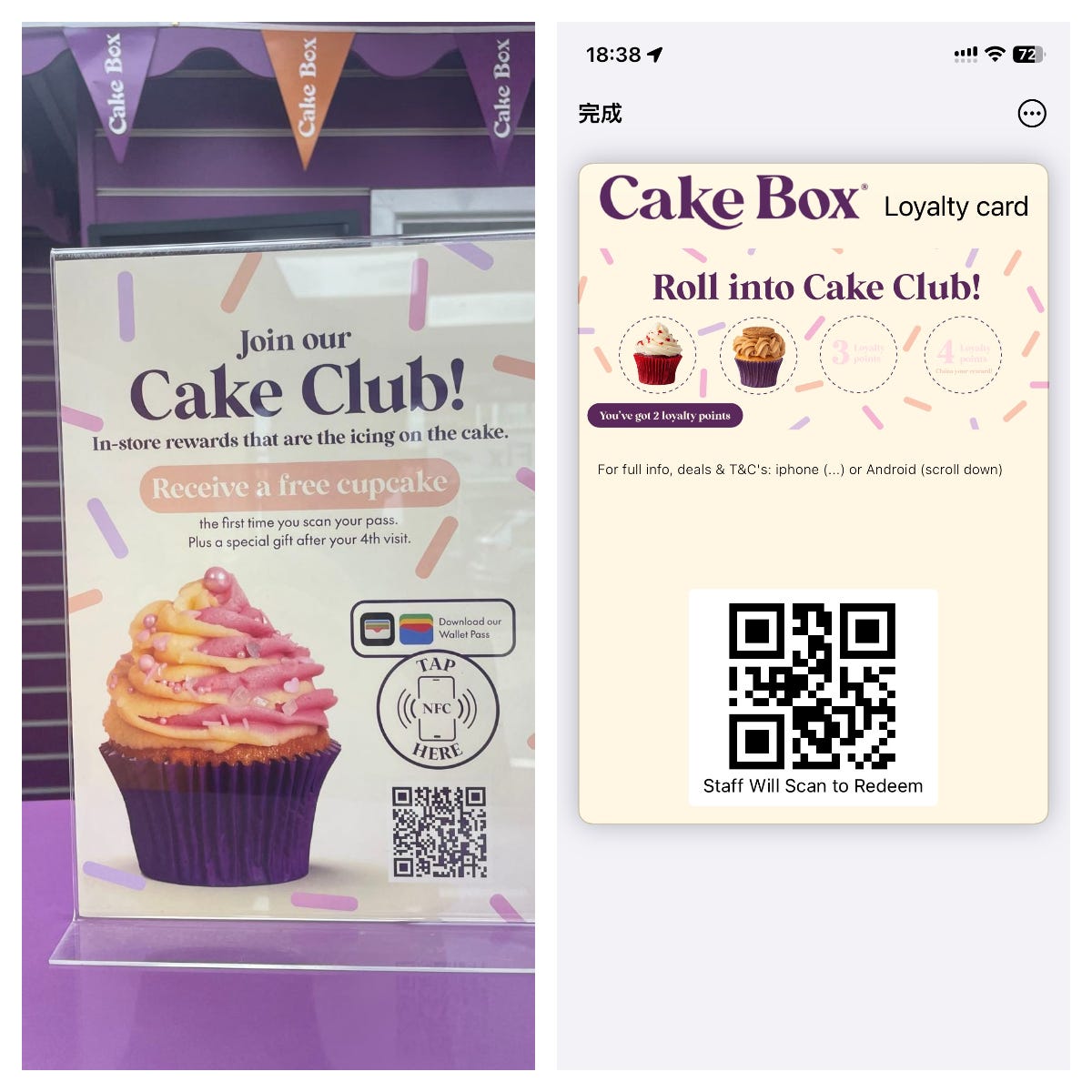

Another example is Cake Box’s new membership program launched this year. After four purchases, customers can get a free cupcake or a discount. Running this kind of program requires professionals.

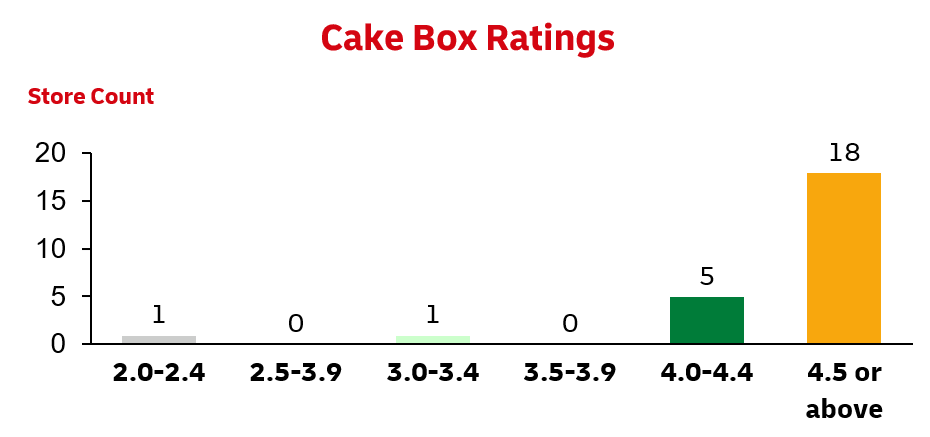

Excellent Service: In the cake industry, service can be even more important than the product itself. Customers buy cakes for big moments, and if delivery is late or the cake looks bad, they can get really angry (we’ve noticed often times the reviews for cake shops are either 5-star or 1-star, with the 1-star ratings mostly due to service issues rather than taste). So, exceptional service is key to gaining repeat customers. Looking at user ratings on Google Maps, Cake Inn offers the best service in the industry, while Cake Box is also very competent. It’s worth noting that scale often works against personalized service, so it’s impressive that Cake Box maintains superior service quality even when being ten times larger than competitors.

Sources: Google Maps, Rome Capital

*The Cake Box rating is a weighted average score from 25 stores in the West Midlands.

The charts use the West Midlands urban area as an example: Cake Box’s stores have a weighted average rating of 4.70, while Cake Shop scores 4.12. Cake Box stores also have an average of 203 reviews per store, compared to just 63 for Cake Shop. This explains why Cake Box’s store performance is nearly double that of Cake Shop.

Sources: Google Maps, Rome Capital

Efficiency in Opening Stores: The company believes that the biggest bottleneck for fast expanding new stores is finding suitable properties. This makes their first-mover advantage crucial—if a community already has a successful Cake Box, new entrants will think twice. Cake Box maintains a pace of opening over 20+ stores a year and is expected to accelerate, i.e. Cake Box is creating a chain of equivalent scale to its competitors each year. In contrast, we estimate that Cake Inn has opened 6 stores this year, Cakes & Bakes has opened 3, and none for Cake Shop. Over time, Cake Box’s advantage will only continue to grow.

Sources: Cake Box, Rome Capital

III. Vast Growth Potential

The management team has indicated 2 growth drivers:

Increase in Number of Stores: They aim to reach 400 locations across the UK in the mid-term.

Growth in Sales per Store: They plan to boost average sales per store from £350,000 to £500,000 through new product launches, brand building, etc.

Yet we believe that Cake Box’s potential is way larger than that.

UK Market:

What is the Market Share Ceiling for Cake Box?

The company estimates that the market size for celebration cakes in the UK is £1.3 billion. Currently, Cake Box’s total store sales amount to £78.8 million, giving them a market share of 6%. Looking at clusters, London’s market size is about £240 million, and Cake Box’s 78 stores in London generate approximately £30 million in revenue. This means the company’s market share in London has reached 12.5%. In addition, the company believes there is still room for expansion in London.

The unassuming Cake Box doesn’t stand out in a glitzy city like London; in fact, we have surveyed some friends in London and none of them have heard of it (don’t get me wrong, Cake Box is still very successful there). The lower-tier cities, with their more local vibes, are where Cake Box really shines. For example, one of Cake Box’s stores in Glasgow (600,000 population, 7th largest city in the UK) generates annual sales of £780,000, placing it among the top five stores in the country. This highlights its popularity and potential for success. Therefore, we conclude that Cake Box's market share nationwide will exceed that of London.

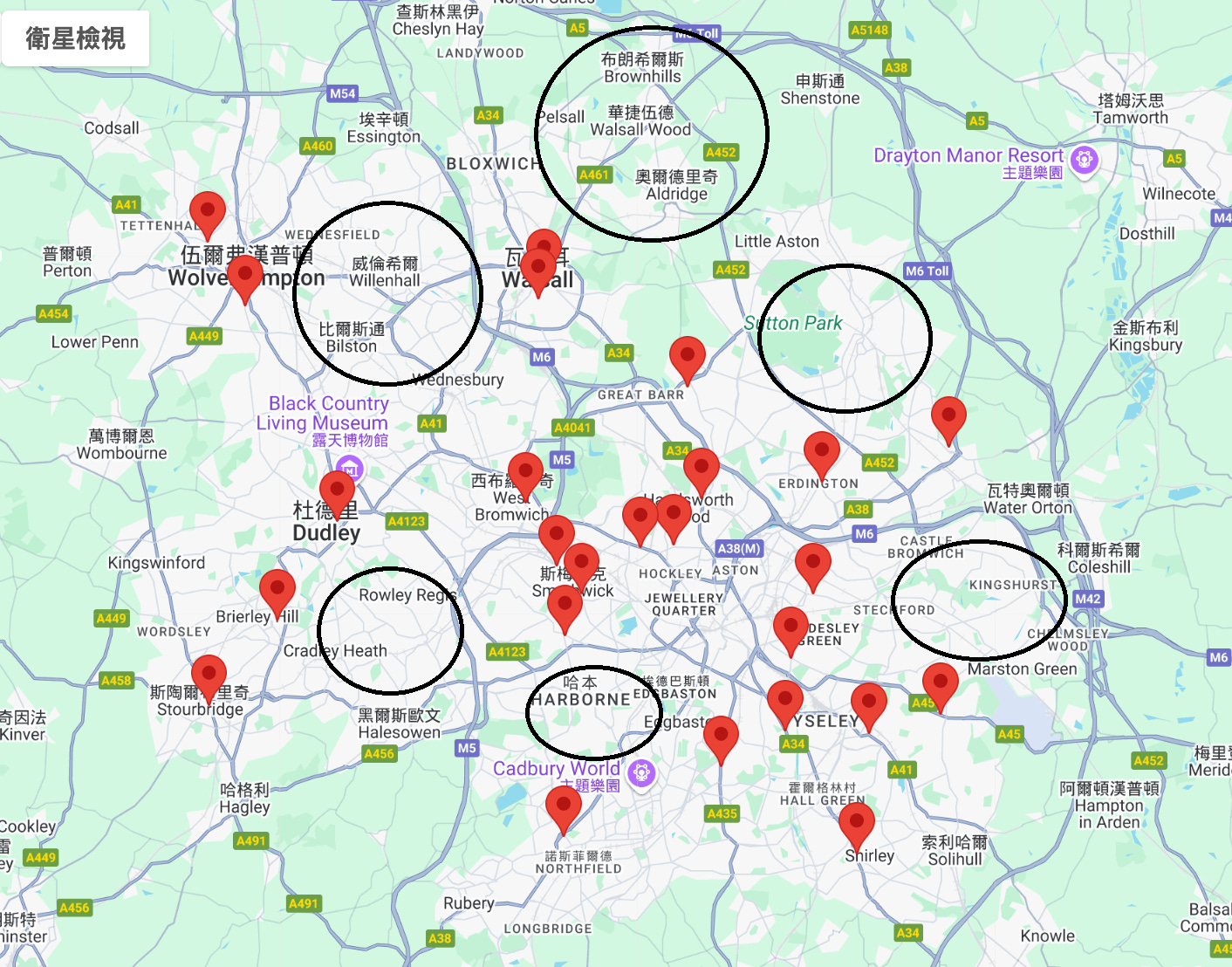

Cake Box’s national expansion is still in the early innings. Taking Birmingham, the UK’s second-largest city, as an example, the map below shows the West Midlands urban area centered around Birmingham, with a total population of about 2.5 million. Cake Box currently has 21 stores and 4 kiosks in this area. Despite being in the region for nearly 10 years, there are still large blank spaces in the market. We compared this with the locations of the largest UK supermarket chain, Tesco. The circled areas on the map are areas that contain Tesco Superstores but no Cake Box yet. We estimate that for one Tesco Superstore in a community can open two Cake Box stores, which suggests that there’s room for over 10 more locations in the West Midlands. BTW, Tesco has more than 800 large stores across the UK. You can imagine how big the potential for Cake Box’s expansion is.

Source: company website, Google Maps, Rome Capital

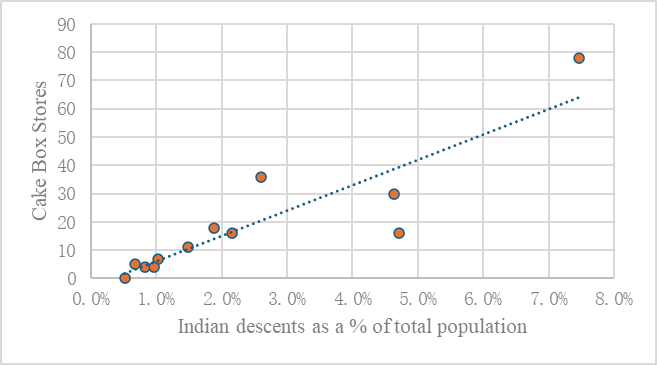

A New Approach to Accelerate Store Openings

So, why hasn’t Cake Box conquered the entire UK market yet? Even as of mid-2023, the company had only one store in Scotland (now they have 5 and expect to reach 8 by the end of 2024), and there are still no Cake Box stores in the densely populated and economically developed areas of York and Oxford Downtown. During our research, we noticed an interesting phenomenon: Cake Box tends to appear more often in communities with a high concentration of people of Indian descent. This isn’t because only Indian people love Cake Box cakes; rather, it’s because the founder, Sukh, is of Indian heritage, and over 90% of their franchisees are also of Indian descent. The expansion of Cake Box has primarily been driven by franchisees, who naturally prefer to operate within their comfort zones.

Source: Wikipedia, Rome Capital

The company has recognized this issue and has launched a brand-new store opening model this year: they proactively select locations and invite franchisees to open stores. The management team has determined that every 100,000 residents could support one store. Currently, their site consultants have identified 200 potential locations, and franchisee feedback has been very positive. They expect to see positive results next year, allowing for more new stores to open each year.

Improving Macroeconomic Factors in the UK

The macroeconomic situation in the UK is gradually improving. The high inflation and high interest rates of the past two years had dampened franchisees' willingness to open new stores and reduced consumers' purchasing power. This even led to some extreme situations where multiple customers would chip in to buy one cake to celebrate their birthdays. However, since mid-2023, the UK economy has started to shift: the Consumer Price Index (CPI) has decreased from a peak of 11% to 2%, GDP has begun to grow again after two years of stagnation, and the UK Central Bank lowered interest rates for the first time in August 2024. All of these factors are expected to improve the willingness of franchisees and consumers alike.

Overseas Market:

Cake Box is actively exploring international expansion. The company has found that there are no similar cake chains in countries like France, the Netherlands, and Belgium. Given the universal appetite for cakes and the simplicity of their business model, we are very optimistic about Cake Box's potential success in the European Continent market, which we expect will be a catalyst for share price when ir realizes.

Margin Expansion Opportunities:

Before 2022, the company’s earnings before tax (EBT) margin consistently exceeded 20%, peaking at 26%. However, over the past two years, it has dropped to 15%. This decline isn’t due to a loss of competitiveness or inflation-related cost pressures; rather, during the same period, the company's gross margin actually increased from 42% to 50%. The real culprit is the management expense ratio, which surged from 18% to 36%, largely due to the investments mentioned earlier. The company has stated that these investments were largely completed in the last fiscal year and is now entering a harvest phase. We expect that as revenue gradually increases, the company’s profit margins will also rise, potentially approaching or even exceeding previous levels.

Sources: company data, Rome Capital

Upside for Cake Box Shares:

Currently, the company’s price-to-earnings (PE) ratio stands at 16x, which is fair for small-cap consumer stocks in the UK. However, considering the potential for accelerated growth and overseas expansion opportunities, the valuation could increase. On the other hand, the company currently offers a dividend yield of 5.3%, providing substantial downside protection for the share price.

Based on the assumptions that Cake Box’s top line would grow at 12% in the next 2 years and net margin picks up from 11.5% to 15%, we expect Cake Box’s profit growth rate would bounce to 20% region. In turn the market would very likely give it a higher multiple at 20. That is 135% upside in two and a half year. With the 5% dividend yield, the IRR would be higher than 45%.

Source: Rome Capital forecasts

Looking long-term, if Cake Box’s market share in the UK reaches 15% with a net profit margin of 18%, revenue and net profit would then hit £200 million and £36 million, respectively. With a PE ratio of 15x, the market capitalization would rise to £540 million. If overseas expansion progresses, the market cap could potentially exceed ten times its current valuation of £70 million.

IV. Why the Market is Wrong

If Cake Box is so outstanding, why hasn’t the market reacted?

Before January 2022, Cake Box was a rising star on the UK stock market, but the share price plummeted from £4 to £1.10 that month. The immediate cause was a financial blogger questioning the company’s financial disclosures (questioning, not a short-sell report). The main issues included delays in disclosing a website security incident, inconsistencies in related-party transaction information, excessively high accounts receivable balances, and the auditor terminating their contract. The company subsequently admitted shortcomings in its internal controls and hired BDO (a leading international accounting firm) for an internal control upgrade. Additionally, the CFO (one of the co-founders and Sukh’s cousin) resigned. Based on our experience and research, such management deficiencies are not uncommon in small-cap companies; they are mistakes rather than intentional wrongdoing. The company’s investments over the past two years have addressed these issues, but the stock price remains dormant.

Source: Google Finance

We believe that the market’s judgment of the company is based on a pessimistic outlook influenced by current high interest rates, low growth, and significant investments in expenses, overlooking the potential benefits of accelerated store openings, profit margin recovery, and overseas expansion. If these catalysts materialize in the future, the company’s profits and valuation could experience a double hit.

Following the sharp decline in the stock price, insider purchases have given us more confidence. CEO Sukh has increased his stake in the £1 to £2.60 price range (observing Sukh's stock transactions reveals that he is a very shrewd investor). Additionally, the former CFO still holds 2.5 million shares after leaving the company, further demonstrating insiders' confidence in the company’s quality and prospects.

Source: Capital IQ

During the period of low stock prices, an Australian private equity firm, River Capital, proposed to privatize the company at £1.60 in June 2023. The board rejected this offer, stating that it "materially undervalued the company." This serves as further evidence that the company’s stock is undervalued. BTW, River Capital is the 3rd largest holders of Cake Box, holding c7%, and has added more positions in this October.

V. Testimonial from Franchisees and Customers

In July and August of this year, we randomly visited four Cake Box stores in different cities and observed some commonalities:

a) At various times of the day, each store experienced 3-5 waves of customers within 10-15 minutes

b) The customers are from diverse backgrounds including White, Black, and Indian ethnicities, indicating a varied customer demographic.

c) The staff were enthusiastic and the quality and taste of the cakes were consistent. Many customers were repeat buyers, demonstrating that both the products and services are well-recognized.

d) The owners and employees of these stores are of Indian descent, and the surrounding communities also have a notable Indian population.

e) Three store employees revealed plans for new store openings, with one franchisee already owning ten locations and planning to expand to seventeen, confirming that the capital return on these stores is attractive.

Highlights from Customer and Franchisee Interviews:

“We buy birthday cakes for everyone in the family from Cake Box because the cakes are delicious, affordable, and the service is convenient.”

“I’ve been buying Cake Box cakes since I lived in England. I’m thrilled that there’s now a Cake Box in Edinburgh, so I can enjoy their cakes again.”

“My experience working with Cake Box headquarters has been excellent; they always prioritize the franchisees’ needs and provide timely assistance.”

“At first, my store's main customers were from the Asian community, but as more people learned about our fresh cream cakes, a wider range of customers began to enjoy them.”

“With more Cake Box stores opening in the future and more customers trying their products, I believe Cake Box will become even more successful.”

Disclaimer:

This is not investment advice. Please consult your advisor and do your own due diligence.

Rome Capital holds Cake Box shares.

I’m from UK and cake box isn’t all that. From not looking at any data or statistics, I can imagine market penetration isn’t that strong and it’s nothing to rave about. Don’t overestimate growth

I believe the extent of incompetence or potential intentional wrongdoing of the management is being slightly underestimated:

"Based on our experience and research, such management deficiencies are not uncommon in small-cap companies; they are mistakes rather than intentional wrongdoing."

This article addresses all the issues, what do you think?

https://knowledge.sharescope.co.uk/2022/01/21/cake-box-holdings-cbox/