GiG- yet another undervalued spin-off

The iGaming affiliate with the best metrics but the lowest valuation

Executive Summary

GiG is a special situation play, which is going to spin off its negative-EV platform business probably in May 2024. Post the spin-off, the two parts can employ the best operation and capital allocation strategy for themselves.

The RemainCo GiG Media is one of the world’s top 3 iGaming affiliate. Management targets 20% organic annual growth with 1-2 acquisitions a year.

The iGaming affiliate business’ moat is deeper than it seems. It’s no longer a game for garage heros. Having better data capabilities and being large are competitive advantages.

GiG has better financial metrics than other peers: more recurring revenue, higher margin, similar organic growth. But GiG Media is trading at 7.3x pro-forma LTM EBITDA while two peers are at 18x and 11.5x.

The SpinCo GiG Platform could turn around under the hands of new management team. The team is incentivized by stock and it could be a multibagger.

Insiders are not only creating value for shareholders through smart capital allocation, also they keeps buying shares with their own money.

Major sport events is going to boost the industry’s growth in 2024.

In conclusion, we expect a 90-230% upside for GiG in next 12 months.

My dear readers,

This time I’m introducing another special situation opportunity, an undervalued spin-off, the play my hero Joel Greenblatt likes the best. Gaming Innovation Group (GIGSEK), a iGaming B2B supplier listed in Sweden, is going to spin off its IT platform business from its affiliate marketing business in May 2024. We welcome this corporate action because we believe the platform business is trading at negative EV, and the spin-off would clarify the two parts’ economics, streamline the incentives, and rationalize their capital allocation. Therefore, we deem the move will extract value and see a 90-230% upside of it.

To make it as precise as possible, we are not going to dive deeply into its business, but rather focus on what we believe the market has missed (still a lot…). If you are interested in what GiG does and the company turnaround history in more details, please read the excellent report by Symmetry Investment A/S.

What does GiG do?

Here we’ll try to tell you what GiG does in the simplest language.

GiG Media: it does affiliate marketing for online casino and sports betting websites (the Operators) to attract players for a commission either through ONE-TIME CPA model (cost per acquisition) or PERPETUAL revenue share. (The difference is super important!) The chart below demonstrates the economics of each model.

The Media segment consists of Publishing and Paid Media. Publishing is the business from the domains the affiliates own, like AskGamblers and WSN, which provide players online casino review, bonus, sports news and analysis, betting odds comp, etc. Paid Media is where the affiliates purchase Google keywords, ad slots on Facebook, Youtube, etc. and post operators’ ads there to attract players.

GiG Media contributes 70% of the group revenue and 80% of EBITDA. The company targets at 20% organic growth and one to two acquisitions each year. It’s a highly profitable business (45-50% EBITDA margin) and cash generative. What to follow is the FTD (First Time Deposits, the new player they introduce to operators. It’s the source for future growth) and the mix between CPA and rev share.

GiG Platform: it’s the backbone IT system for iGaming operators. These offerings include a Player Account Management solution, Frontend Development (UX), Sportsbook, Content Management System (CMS), payment solutions, etc. Usually platform providers charge the operators a 4-7% perpetual revenue share, but GiG also offers a subscription model charging 20-50k Euro each month. So it’s a SaaS business.

Yet the Platform was a bit disappointing in the past because there was a mismatch of management capabilities: the former Group CEO was a Media guy but the Board was made up of Platform people, quite interesting. That is exactly why the company decided to spin it off. Now the new management team is in place and the leading indicator looks encouraging: sales pipeline has doubled since Q4 2023 and GiG expects the pipeline to convert to sales growth starting from the second half of 2024.

This business has a moat!

Now we understand what GiG is doing. The momentum is strong and it’s traded at discounted multiple, which usually result from the lack of competitive moat in the long term. Quite the opposite, the business becomes increasingly in favor of leading players.

For the platform business, it’s quite straightforward. Switching cost is obviously a moat for software providers, as long as the tech is good. If an operator decides to go on its own, it would take 50-80 developers for a year to get it going, plus the results are not guaranteed. Per our channel check, GiG Platform’s tech is above average and the subscription fee model (instead of a proportion of GGR) it charges is reasonable. In fact, even large operators like Bettson (a $1.4bn mktcap company) choose to work with Bettson. If the new management could turn it into a fast growing company with a reasonable margin (actually it has better growth and EBITDA margin than Salesforce.), it should deserve a valuation of a SaaS company.

For the media business, the moat is less obvious. A website relies on Google search to guide viewers to other people’s website. Sounds like anyone can do it. It used to be. But not anymore.

When I visit the business for the very first time, I thought the content and branding of the sites are the key. For sports betting, to some extent it’s true. Yet for online casino, the content needs to be acceptable but it’s not the game changer. Think about how impatient the gamblers are: they search on Google fore casino review and more importantly for bonus. Actually the one who cares more about the content is Google. Google panelizes bad behaviors and rewards good players, so having good domains and managing them carefully and smartly is a moat. Therefore, good affiliates should 1) have good data capabilities for search engine optimization (SEO) and 2) have domains with good track record to succeed on Google side.

Scale offers an advantage on the affiliate business, too. On the Google side, 1) it’s getting more and more difficult for small affiliates to create good content and linked to big portals. You need to reach critical mass to be ranked. (80% of the traffic goes to the top 3 links) 2) for Paid Media specifically, Google helps large client build up knowledge and data, so their conversion will be better and cheaper. On the operator side, to a lesser extend, being big offers some advantages because 1) bigger operators have more compliance concerns so they are more willing to work with compliant affiliates 2) bigger affiliates can sit down with operators to work on special campaigns. Therefore, the industry is over the age where two tech geeks can start a business in their garage to compete with the big boys.

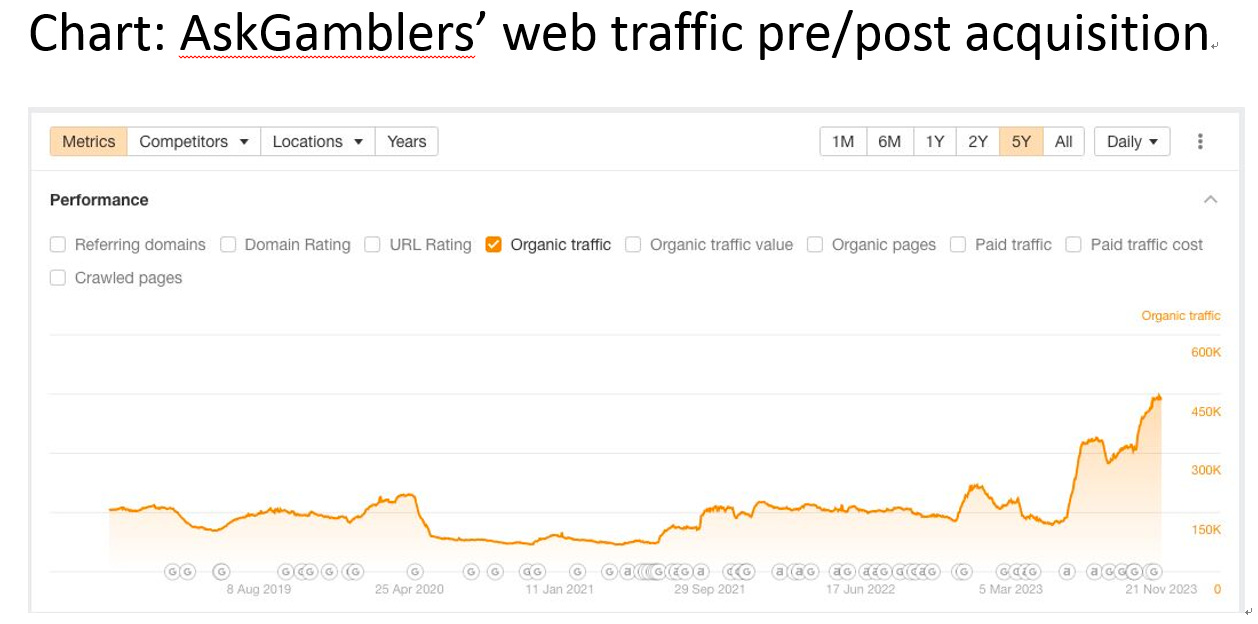

Based on our communications with the industry experts, GiG is a pioneer in data tech in the industry. And their data tech has helped AskGamblers regain fast growth momentum. (It’s between 27’30 and 30’00. Highly recommend you to go over the whole video to have a better understanding on AskGamblers, the integration, GiG’s culture and some trends on affiliate industry.)

Some may ask why the operators not go on their own, is decoupling a big risk? Not a all. That’s when economy of scale and tech capabilities come to play. It’s not economic at all for operators to build the capability. The bigger problem is, an affiliate can use one link to promote 100 operators, but an operator could only do one. No one in the iGaming industry we spoke with thinks affiliate will disappear or play a less important role. They will co-exist with the operators for a long, long time.

Nor we see major risks of big tech/media behemoths enter the industry. Unlike Google trying to steal Bookings.com’s business through Google Map, relating to gambling probably is one of the last things Google wants to do. On the other hand, media companies like ESPN do try to get a spoon of this area, but a lot of them are working with the big affiliates. For example, The News Corp chose to work with GiG in UK and Ireland on casion and sports betting content. A new source for FTDs! So we are comfortable to say the competitive landscape is pretty friendly to the existing bigger affiliates.

To conclude, if a business with no economic moat is rated C, I’ll give a A to the Platform (of course, if the business is going well). That’s the type of business Constellation Software wants to buy, if they don’t have an ESG mandate… For Media, I’ll give it a C+. It’s not a business can be run by an idiot, nor the market would give it 30x PE even if it does not grow. But probably it’s worth 10x when it’s not growing much.

Grow, grow, grow!

The reason why I think GiG is worth much more than it is today is because of the growth of both the company and whole industry. The top 3 affiliates are leading the charge.

First of all, the online gambling industry is expect to grow at double digit for the next 5 years. More and more countries are legalizing iGaming. Even for European countries as the forerunners, there are still room for penetration growth in the continent. Given the advantages of GiG’s data-savvy and scale advantage, it targets at 20% organic growth every year.

Secondly, it’s still a very fragmented industry. The affiliate market size is expected to be around $10bn in 2023. If that’s accurate, the market leader Better Collective only has a 3-4% market share, followed by 1-1.5% of Gambling.com and GiG. Therefore, there are many M&A opportunities. Thankfully GiG is really prudential in M&A, they have only made three acquisitions in recent years at reasonable or very attractive price.

SportnCo is a transformational deal for the platform, with complementary geography and better tech stack (now the whole GiG sportsbook platform is on SportnCo). The 18.6x ex-earnout EV/EBITDA was a bit lavish, but it has strategic value. The best deal is definitely AskGamblers. They bought it at 4x runrate EBITDA. What’s better, 25m of the 45m would be paid in 24 months post the deal. What’s even better, the integration is so successful that in Q4 2023, three quarters after the deal closure, AskGamblers’ revenue up 93%, FTD up 62%, and EBITDA more than doubled. In Dec 2023, GiG Media closed another deal for 3.6x 2024E EBITDA. Looks like another great deal. Going forward, GiG Media would target 1-2 deal each year. We applaud for this responsible strategy as too many affiliates have failed due to undisciplined acquisitions.

For 2024 specifically, the company is guiding €135mn revenue for media. The drivers include organic growth brought by industry growth and 2024 Euro Cup and Olympics, plus the full-year consolidation of Time2play and Askgamblers would contribute. Therefore, we believe €135mn is not difficult to achieve.

Valuation: where the market is way off!

Now we come to the most important and exciting part. Our analysis suggests GiG is undervalued on both absolute and relative basis. It trades at a low multiple of its near-term earnings (under 6x 2024 EBITDA). Based on a conservative 10x multiple of our 2025 FCF estimate, GiG's share price could more than double within two years.

The really interesting part is the relative value, which investors would usually rely on. GiG’s implied valuation is at a material discount to its peers. Given GiG comprises two segments, a SOTP analysis is appropriate.

A. Media

On the media side, there are a handful public peer companies, yet we don’t believe any of them works as a good comp. Actually GiG is of higher quality than all of them. Obviously the smaller ones are either distressed or have heavy unregulated market exposure. They don’t count.

The bigger ones, i.e. Better Collective and Gambling.com, are traded at higher valuation. Unlike other investors tend to give a discount to GiG due to its scale disadvantage over BETCO and non-US listing disadvantage over GAMB, we believe GiG should have a premium instead of discount. Here’s why:

1. GiG has much more recurring revenue than peers.

We have touched on the difference between the one-time CPA model and the recurring revenue share model. GiG’s revenue consists of much less one-time CPA revenue than the other two, which means GiG Media’s revenue stream is much more stable and predictable than them.

The advantages of revenue share are recognized by Better Collective, too. BETCO is trying to increase their revenue share contribution and so is Catena. Yet as today 44% of BETCO’s revenue is still one-time nature because it’s the prevalent model in the US. As a result, it can be highly distorted by the legalization of one state in the US or a major sport event in a single quarter. For example, the 27% revenue decline in Jan 24 was a result of the high base caused by Ohio legalization spike in Jan 23. As a result, the CPA-heavy affiliates struggle to find new FTDs every day, or they can quickly shrink.

In comparison, revenue share can bring recurring revenue for decade long and provide higher net present value (NPV) than CPA. Apart from trust issue, affiliates only have the incentive to use CPA when the CPA commission is higher than the first year revenue share commission. According the model provided by BETCO and our calculation, the first year rev share commission accounts for 36% of the NPV. That is to say, on one hand, the NPV of revenue share probably is twice of the CPA revenue (assuming the CPA is 50% of the NPV). On the other hand, if the CPA revenue is converted into recurring revenue model, assuming the average player age is at the second year, the revenue would decrease by 62% (1 – 19%/50%). That is to say, BETCO’s revenue would be 258m Euro instead of 355m Euro. Therefore, the scale difference between GiG and BETCO is smaller than it seems. GiG has c105m Euro pro-forma revenue if it’s all in rev share, 41% of BETCO. Yet its EV is only 17% of BETCO’s!

In conclusion, GiG Media is like a SaaS company while BETCO and GAMB are like on-premise software companies. You know which one enjoys the higher valuation.

2. GiG’s focus markets has better economics than peers’.

GiG generates significantly better margin than BETCO and GAMB. One of the key difference is the key markets they operate in. When we checked on the public affiliate companies’ business strategy, we found almost all eyes in the past 5 years have been on US market, with GiG and Raketech being the only exceptions.

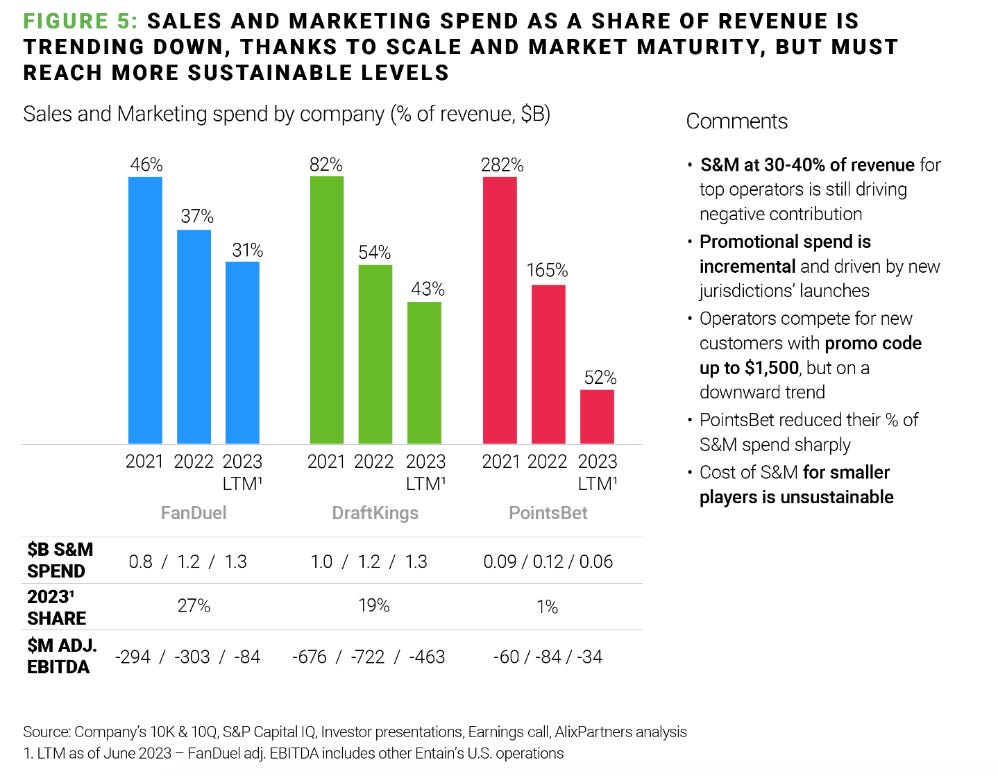

Yes, the US is the world’s largest economy and the market is being regulated state by state, a fertile virgin land. Yet it is not without flaws. Firstly, it’s a sports betting driven market as most states are not open to online casino. 22 US states has opened to online sports betting but only 5 to online casino in 2022. Sports betting has a higher player base but lower player value than casino players. And its margin for affiliates is lower. Secondly, US operators has realized they have paid too much for customer acquisition, as much as $1,000 per player, so the CPA fee is going to trend down. Thirdly, US online gaming market is more consolidated at the moment due to the regulation complexity, so it’s more difficult to bargain with the operators when they decide to cut CPA price. Lastly, there are not going to be any new state opening in 2024, so the US-reliant affiliates is going to face a very tough comp this year.

As a result, after focusing on US expansion for two years, GAMB has shifted back to Europe by acquiring XL Media’s European business, stating ‘while expansion of gambling in the U.S. grabs all the headlines these days, many of the industry’s most attractive markets remain in Europe’. In comparison, GiG has been the contrarian and has ‘stolen’ some best Europen assets such as AskGamblers from FOMO sellers like Catena. GiG’s does not plan to invest a lot in the US in the next 24 months until the market becomes more favorable.

3. GiG is more dependent on organic growth and has a much prudent M&A strategy.

A key reason why affiliates like XL Media and Catena failed is aggressive acquisitions. GiG has been very prudent and selective, planning to do only 1-2 acquisitions each year. If you compare the organic growth rate among peers, GiG Media actually grows in similar pace with BETCO. GAMB’s growth was faster but not very profitable. Furthermore, BETCO is a roll-up company spending most of its OCF on acquisitions and GAMB has been very acquisitive in the past two years, too. Therefore, GiG has much more discipline and is at much lower risk.

4. GiG has much better FCF generation and is more attractive on EV/FCF basis

GiG’s operating cashflow is 46% of BETCO and 227% of GAMB. According to our channel check, the capex of GiG is mainly on the Platform. Media only accounts for 20-25% of total spending. That is to say, the consolidated financial statements have overshadowed GiG Media’s superior cash generation ability. Both BETCO and GAMB are trading at around 40x EV/FCF. Do you think it’s fair to give GiG 10x EV/FCF?

In conclusion, GiG Media should have a higher multiple than Better Collective and Gambling.com. Yet it’s also likely that those two are overvalued if their growth stalls, especially BETCO. But assuming the three companies can grow at the consensus rates (all at double digits), 15x LTM EBITDA is not undemanding. Therefore, putting GAMB and BETCO’s multiple to GiG media, we get GiG Media’s EV at €830-1240mn, 124%-234% higher than today’s implied EV.

B. Platform

It is really difficult to find a good comp for GiG Platform, a conclusion echoed by sell-side analysts. The main differentiator in platform peer valuations is the momentum of their businesses. Many listed peers are sub-scale, over-dependent on a single customer. It leads to a wild range in valuations between struggling and performing companies. If we look at the performing B2B platform/technology companies, we can see that companies such as Evolution Gaming trade at a mid-teen multiple of NTM EBITDA which probably serves as a ceiling.

However, when examining previous M&A transactions in this space over the last two years, B2B platform businesses rarely traded at less than 10x EBITDA. Given GiG Platform’s operational momentum, operating leverage and fresh leadership leading to strong medium-term prospects, a 10x LTM EBITDA is a conservative multiple. That would put a 110m Euro value for our SOTP valuation.

C. Putting things together

With SOTP approach, putting GiG Media 15x at NTM EBITDA and GiG Platform 10x at LTM EBITDA, we believe the upside of GiG is 150% at the moment.

Key risks and the remedies

Google Algorithm Changes Impacting the Media.

Remedy: affiliates with more diversified assets and deeper understanding with Google rules have a better chance to survive the changes.

Regulatory Changes

Remedy: affiliates are more geographically diversified and have more revenue from regulated markets are safer.

Lower margin paid media taking a much bigger revenue contribution

Remedy: industry people have different opinions on the growth of publishing and paid media. Anyway, they say GiG is really good at new forms of media such as social media.

Platform Partners Churning due to in-Sourcing

Remedy: GiG’s subscription fee model is more reasonable. One of GiG Platform’s customers Sky City is one of the key shareholders. The other one Bettson looks quite happy with GiG at the moment.

Disclaimer

This is not an investment advice. Please do your own due diligence. We hold positions in GiG stock.

Alex, thanks for sharing. One question: to you, buying this stock before or after the spin-off.. which would be a better strategy?

A follow-up question: how is the spin-off progress so far?