NCR Atleos (NATL NYSE)- the SaaS-like transformation of the ATM Industry

We see a 15% 3-year IRR even in our bear case, and 25-43% if things turns out brighter

Dear Readers,

The level of uncertainty in global markets has risen sharply in recent weeks. In such a challenging environment, industries like consumer discretionary are likely to face significant headwinds. However, companies that provide mission-critical services to their customers tend to demonstrate greater resilience.

NCR Atleos is one such company, with 80% of its revenue derived from hardware maintenance, software subscriptions, and transaction services that support banks’ ATM networks. This highly recurring revenue stream remains stable unless there is a systemic banking crisis.

More importantly, Atleos—a recently spun-off company—is undergoing a SaaS-like transformation, shifting from a traditional ATM sales and service model to a comprehensive ATM-as-a-Service (ATMaaS) provider. This transition allows Atleos to:

Increase its wallet share by 2.0–2.5x,

Achieve higher margins, and

Enhance revenue stability with a more recurring business model.

Despite these structural tailwinds, the stock continues to trade at a distressed multiple, likely due to the misconception that ATMs are a declining business. However, Atleos has provided strong near- and long-term guidance, and as its ATMaaS adoption accelerates, the market may soon recognize its true value.

NCR Atleos (NATL NYSE)

Price: 27.0

2027 target price: 48

Base case 3-year IRR: 25%

MktCap: $1,972m

EV: $4,489m

EV/adj. EBITDA: 6.2x

Adj. PE: 9.5x

Summary

NCR Atleos is one of the two dominant players in the global ATM manufacturing industry. While overall ATM installations are experiencing a slight decline, Atleos is poised for growth by expanding its ATM-as-a-Service (ATMaaS) model, enabling banks to outsource their ATM operations. This approach allows banks to reduce costs by up to 45% and aligns with the secular trend of outsourcing in the industry. Atleos is uniquely positioned to capitalize on this transformation, particularly following its acquisition of Cardtronics. Beyond driving top-line growth, ATMaaS also enhances profitability, offering higher margins.

Benefiting from these industry tailwinds, Atleos' management anticipates EBITDA growth accelerating from high single digits (HSD) to mid-double digits (MDD). However, the stock currently trades at 6.2x EV/EBITDA and 9.5x PE, implying market skepticism regarding future growth. As Atleos continues to execute on its growth strategy, deleverage its balance sheet, and initiate shareholder returns, even a moderate valuation re-rating could result in a 25-43% IRR over a three-year investment horizon. If the company achieves the growth trajectory projected by management, the upside potential could be significantly higher. Furthermore, Atleos stands to benefit as banks prioritize cost efficiency amid economic uncertainty, making it a potential hedge within a diversified portfolio.

Company Overview

NCR Atleos is the world’s leading ATM manufacturer, operating a fleet of 600,000 ATMs that serve financial institutions across more than 140 countries. This segment, known as Self-Service Banking, contributes 62% of the company's total revenue. Unlike other OEMs, 60% of Atleos’ Self-Service Banking revenue is recurring, driven by maintenance contracts and software subscriptions, providing stability and predictable cash flow.

Additionally, Atleos owns and operates the largest independent ATM deployer (IAD) network, with 78,000 ATMs across North America and Europe, following its 2021 acquisition of Cardtronics. This IAD network consists of company-owned ATMs strategically placed in high-traffic retail locations, benefiting multiple stakeholders: retailers gain an additional revenue stream, banks expand their network for customers, and cardholders enjoy greater convenience in accessing banking services. This segment, which represents 30% of Atleos' total revenue, is characterized by recurring revenue streams and strong network effects, reinforcing the company’s competitive position in the market.

Atleos was spun off from NCR Corporation in October 2023. Prior to the spin-off, NCR was the leading player in both the ATM and retail checkout hardware markets. However, NCR prioritized its retail segment due to its stronger growth trajectory, resulting in the ATM business being relatively underfunded and overlooked. In fact, NCR was actually better positioned in the ATM industry, as the market presents high barriers to entry, with minimal risk of new competitors emerging. In contrast, the retail technology segment faces intensifying competition.

The spin-off has allowed Atleos to operate with a dedicated management team and optimized capital allocation strategies, enabling it to unlock greater value from its ATM business. The success of this transition is reflected in Atleos' strong stock performance since the separation.

Growth Opportunities

Contrary to the common perception that ATMs are becoming obsolete, the market remains resilient. The global installed base of ATMs is currently just under 3 million units and is declining at a rate of approximately 2% per year. However, China accounts for 75% of this decline. Excluding China, the global ATM market is contracting at a more modest rate of 1% annually.

In the U.S. market, the decade-long trend of bank branch closures reached its inflection point in 2023, with banks recognizing that they overcorrected by closing too many branches. As a result, some institutions have begun reopening branches to improve customer access. Additionally, rising labor costs are prompting U.S. banks to expand ATM deployment both inside and outside branches, as self-service solutions help reduce operational expenses. These new ATMs are increasingly sophisticated, offering enhanced functionalities and commanding higher price points.

For Atleos’ core markets, we conservatively project a -1% CAGR over the next five years, reflecting a measured outlook on industry trends.

The primary growth driver for Atleos is its ATMaaS offering, which is widely recognized as a structural shift in the industry. Experts across the ATM sector and banking industry view ATMaaS as a long-term transformational trend.

The rationale is straightforward: operating an ATM fleet is costly and generates minimal direct revenue for banks. The machine only accounts for 10-15% of the total life-cycle costs, while the rest was spent on maintenance, software, cash management, and money transactions, etc. Traditionally, banks either manage ATMs in-house or outsource to multiple third-party providers, often relying on 7–10 different service vendors. This fragmented approach drives up costs and creates significant operational complexity.

However, if a third party consolidates and manages ATMs from multiple banks, it creates significant cost efficiencies through economies of scale and network density. For example, a leading national bank in the US owns 15,000-20,000 ATMs, dwarfed by the 55,000 ATMs owned by Atleo’s Allpoint Network (IAD). On top of that, adding more ATMs from the banks to Atleo’s fleet would further dilute the operation cost. For example, Atleo’s cash-in-transit costs, which is rout-based and accounts for 30-40% of the ATM operating costs for the banks, are 50% lower than the banks’ thanks to economy of scale. Furthermore, for smaller banks, ATMaaS not only creates value from cost-saving, but also improves the ATM customer experience because Atleos has more advanced technological capabilities and guarantees up-time. Given these efficiencies, it makes sense for the banks to make this transition. Industry consensus suggests that the global ATM fleet will gradually transition to an outsourced model over time.

Similar to the SaaS model, the wallet share gains from ATMaaS expands Atleos' revenue potential. Under the traditional model, Atleos primarily generate revenue from:

1. Upfront machine sales in the first year

2. Software subscriptions and maintenance fees in subsequent years

In contrast, ATMaaS operates on a subscription model that encompasses security operations, cash management, and transaction processing, significantly expanding the total revenue per ATM by 2.0–2.5x over its lifecycle. Additionally, the EBITDA margin on incremental ATMaaS revenue is over 5 percentage points higher than the traditional model (~30% vs. 20–25%).

Beyond margin expansion, ATMaaS transforms Atleos' revenue profile from a front-loaded model to a recurring revenue stream, significantly enhancing financial predictability and long-term value creation. This shift provides sustainable growth, higher margins, and improved revenue visibility. As of year-end 2024, Atleos has 28,400 ATMs under the ATMaaS model, with an ARPU of $8,600. Management aims to expand the fleet to 125,000 ATMs within the next 3–5 years, increase ARPU to over $10,000, and ongoing transition the remaining 80% of its ATM fleet to the ATMaaS model further ahead. These strategic initiatives are expected to drive a 6% CAGR in revenue and mid-teens CAGR in EBITDA through 2027. Additionally, FCF is projected to triple, further reinforcing Atleos' long-term financial strength and value creation potential.

Competition

Atleos is uniquely positioned to lead in the ATMaaS market, leveraging two key competitive advantages:

Industry-leading software and service capabilities – As the leading ATM OEM, Atleos offers banking-grade software solutions and best-in-class service infrastructure the IAD players don’t have, ensuring superior reliability and efficiency to fulfil bank customers needs

Fleet manage capabilities as the largest IAD player – With 80,000 ATMs, significantly larger than any individual bank’s fleet globally, Atleos benefits from scale efficiencies and cost advantages following its acquisition of Cardtronics.

Globally, there are approximately 3 million ATMs in operation. APAC markets are dominated by local players, while in the rest of the world, NCR Atleos and Diebold Nixdorf—both U.S.-based companies—control over 70% of the 1.9 million non-APAC ATMs. This strong market position reinforces Atleos’ ability to capture the industry's shift toward outsourced ATM operations.

Diebold Nixdorf (DBD NYSE)

Diebold and Atleos can be compared to Toyota and Honda—their products and services are largely similar, with regional variations in market strength. The duopoly structure is a deliberate choice by bank customers, who seek to avoid dependence on a single supplier and maintain competitive pricing and service quality.

Currently, Diebold is in the process of reestablishing itself following its 2023 bankruptcy, which was driven by high leverage and COVID-related supply chain disruptions. As part of its recovery strategy, Diebold is focused on:

Enhancing product value through expanded offerings, particularly cash-recycler ATMs

Restoring margins through Kaizen-driven operational efficiencies

Maintaining a low-leverage balance sheet to ensure financial stability

While Diebold acknowledges the industry’s transition toward the ATMaaS model, it is not actively pursuing aggressive expansion in this segment at this stage. This presents an opportunity for Atleos to strengthen its leadership in ATMaaS while Diebold prioritizes its restructuring efforts.

Hyosung

Similar to Diebold Nixdorf, Hyosung remains focused on selling ATMs rather than expanding into the ATMaaS model. However, Hyosung differentiates itself through a distinct value proposition, offering lower-cost ATMs with fewer advanced features compared to its competitors.

One key limitation for Hyosung in the ATM outsourcing market is its lack of a robust service network in North America and Europe. This absence of infrastructure makes it challenging for the company to scale an ATMaaS offering in these regions, further solidifying Atleos’ competitive advantage in outsourced ATM management.

Brink’s (BCO NYSE)

Atleos’ most relevant competitor in the ATMaaS market is The Brink’s Company, the leading cash-in-transit service provider. Through a series of acquisitions, Brink’s has built a fleet of 150,000 ATMs, comprising both partial and full ATMaaS models, as well as independent IAD units. This compares to Atleos’ larger fleet of 200,000 ATMs.

However, Brink’s generates significantly less revenue per ATM, with an estimated ARPU of $3,300. This disparity indicates that Atleos provides a broader and more comprehensive suite of services, positioning it as the leading full-service ATMaaS provider. Beyond Atleos and Brink’s, all other ATM outsourcing players operate at a subscale level,

Euronet (EEFT NASDAQ)

Euronet is a regional ATM operator with a fleet of over 50,000 ATMs, primarily concentrated in Europe. While the company does engage in ATM outsourcing in certain European markets, its primary focus lies in payment technology rather than ATMaaS expansion. As a result, Euronet’s ATM outsourcing remain a secondary business, distinguishing it from Atleos and Brink’s, which are more dedicated to the ATM outsourcing model.

Management and incentives

The majority of Atleos’ management team consists of seasoned and reputational professionals from NCR Corporation, bringing extensive industry expertise. However, we would prefer to see higher levels of insider stock ownership, as greater alignment with shareholders would reinforce management’s long-term commitment to value creation.

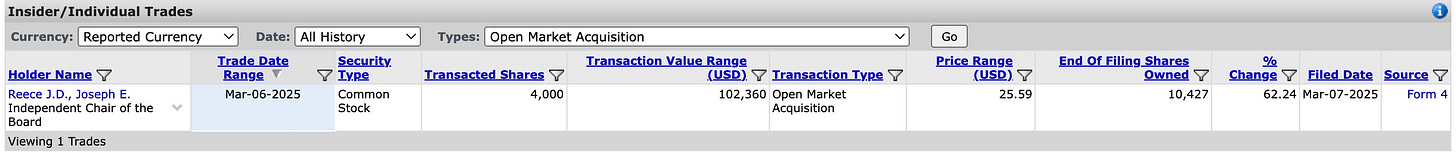

For instance, CEO Tim Oliver currently owns 0.22% of Atleos, primarily through the company’s incentive program. Encouragingly, in early March 2025, Atleos saw its first-ever insider purchase on the open market—Joseph Reece, Chair of the Board, acquired 4,000 shares at $25.59 per share. This marks a positive signal of confidence in the company’s prospects.

Valuation

Our assumptions remain highly conservative compared to company guidance, incorporating several cautious factors:

Our ATMaaS unit growth projections are significantly lower than the company's publicly stated targets and street consensus.

The industry is in a replacement cycle in the next 2-3 years so the hardware sales should benefit, but we still underwrite a 4% decline in hardware sales.

We do not adjust for stock-based compensation or restructuring costs in our EBITDA and EPS calculations, maintaining a more conservative earnings quality outlook.

We assume very little multiple expansion in our base case, and even slight contraction in the bear case, despite the potential for valuation re-rating as the business scales.

Even under these conservative assumptions, NATL’s current valuation appears highly attractive, offering 16-43% 3-year IRR with a favorable risk-reward profile. The implied P/E ratio remains low across various scenarios, suggesting meaningful upside with limited downside risk.

More importantly, we anticipate that ATMaaS adoption will accelerate post 2027, making multiple expansion increasingly likely, which in turn could drive higher IRR than our base-case estimates.

Catalysts

1. Delivery of 2025 guidance – Though being a bit aggressive on the ATMaaS target, Atleos have been on a guidance-beating mode on its overall financials since the spinoff. The company guided for 6-9% EBITDA growth, 21-27% EPS growth, 7-24% FCF growth in 2025. It’s unbelievable for such a growthy company to stuck at such a distressed valuation.

2. Acceleration of ATMaaS Adoption – We anticipate a faster adoption rate for ATM-as-a-Service (ATMaaS) as the ATM industry enters a new upgrade cycle, following the previous cycle in 2018–2019. This shift is further driven by the Windows 11 upgrade requirements, which are prompting banks to refresh their ATM fleets. We estimate that Atleos’ annual new machine demand will exceed the previous years’ level by 10,000 units, increasing the likelihood that banks will transition to outsourced ATM management rather than continuing with in-house operations.

3. Post-Spinoff Strategic Focus – Following its separation from NCR Corporation, Atleos can now allocate more resources toward expanding its ATMaaS initiatives. Under NCR’s ownership, the ATM segment received limited attention, as management prioritized the higher-growth retail technology business. With greater independence, Atleos is now positioned to fully capitalize on the industry shift toward outsourcing.

4. Value Creation Through Capital Allocation – The spinoff initially left Atleos with a leveraged balance sheet, at 3.7x net debt/EBITDA in 2023. However, within a year, the company successfully reduced leverage to 3.2x, with a similar reduction expected in 2025. The interest expense savings from deleveraging are projected to contribute over 10% net income growth, further strengthening Atleos’ financial position. Additionally, the company plans to initiate a share buyback program in H2 2025, signaling confidence in its long-term value creation strategy.

Risks & Mitigation

Given Atleos’ already distressed valuation, investors can generate strong returns even if the company simply maintains its current momentum through 2024, without requiring further acceleration. As a result, the risk of capital loss would primarily stem from a significant deterioration in the business, which could occur under the following extreme scenarios:

Very slow ATMaaS adoption, as NATL has changed the original 2027 goal to a 3-5 year goal – We would closely monitor the ATMaaS units, ARPU and revenue. We don’t believe a slight miss from our base case assumptions would change our thesis, because it’s a relatively new concept and banks are slow to adopt new things, and more importantly, the current stock price doesn’t reflect much expectations to ATMaaS.

A rapid and widespread decline in cash and ATM usage across North America and Europe – However, we consider this unlikely within the next five years. Even in China, which has functioned as a cashless society for over a decade, ATMs remain in operation, highlighting the persistence of cash infrastructure.

A 1929-style financial crisis or a major global conflict leading to widespread bank closures – In such scenarios, systemic risks would impact entire financial markets, making it more appropriate to hedge at the portfolio level rather than on an individual stock basis.

Overall, Atleos' current valuation offers a strong margin of safety, with limited downside risk unless faced with an unprecedented industry collapse or macroeconomic catastrophe.

Disclaimer

This is not an investment advice. Please do your on due dilligence or advice your advisors

We hold positions in NATL stock.

Excellent write up Alex, my old boss was a big fan of this one

Indeed, a good write-up that provides me a better understanding of this industry. The shift to ATMaaS might just allow this company to escape the general view of it having its fortunes tied to the declining ATM business. Many thanks for the insights.