Home sweet home: SharkNinja (NYSE: SN), a global household appliance leader

a newly spin-off that overlooked by the market with a potential 50-130% upside!

Executive Summary

SharkNinja is a leading small household appliance company in US and Europe. It is a recently spin-off from JS Global Lifestyle (1699.HK) on Jul 31st. The stock is traded at an absurdly low 12.8x LTM PE partly because of market’s unfamiliarity to it (so far I don’t find any sellside coverages), and partly due to market’s concern to its corporate governance (it’s a Cayman incorporated company with a Chinese businessman owning 57% of the equity). However, as a follower of the whole spin-off process and who has access to the Chairman, I’m pretty sure it is a very good business with great corporate governance:

SN’s history dated back to 1994 when it was funded by a Canadian entrepreneur in the US.

Since it was acquired by JS Global Lifestyle in 2017, it was largely kept independent and run by its co-founder.

With sharp understanding of customers’ pain points, fast-pace innovation, and power global supply chain, SN has become the leading mid-to-high end appliance brand in both US and Europe.

SN has ample growth opportunity in adjacent categories and Europe Continent. Especially now the channel destocking is over and management guided strong growth in Q2. We can expect double-digit growth in future years.

2022 was a low base both in terms of growth and margin due to the demand hike in 2021 and COVID supply chain issues in 2022. The margin is recovering in 2023 and management expects further operation leverage in the longer term.

SN’s controlling shareholder Mr. Wang’s interests are strongly aligned with shareholders, as SN is his major source of wealth out of China.

Mr. Wang is very wise on capital allocation, proven by this spin-off and the stock repurchase of JS. Yet it is overshadowed by both the capital control of China and the misunderstanding of US investors.

Due to the capital control of China, there would be consistent forced sale in the first few months after the spin-off, which create good buying opportunity.

Small household appliance peers are traded at 20-30x PE, while SN, even being an equivalent if not better company, is traded at only 12.8x LTM PE.

I believe SharkNinja deserves at least 20x PE, therefore I expect a 50-130%+ upside of the stock. The catalysts can be the release of its Q2 results, some initiation by investment banks, or US institutional investors get involved.

Preface

If the summary interests you, great! Let’s rock and roll for this long journey!

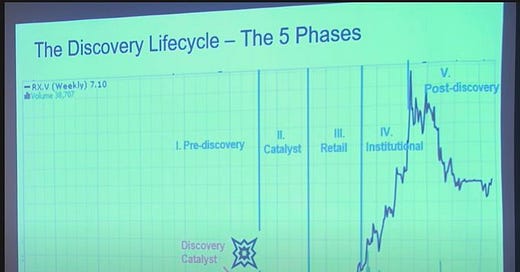

This is a semi-special situation investment opportunity. It’s China-related. It’s very new. So probably the company is not well-known to the US investing community. Right now it is a classic case when a stock is still a stranger to the market and transiting from the pre-discovery phase to the catalyst phase. But it’s not a small cap so institutional involement is not a big problem.

With the convenience of having followed (and invested in) the company (both JS and SN) since the beginning of the spin-off, as well as being the country folk and sharing the same concern with its controlling shareholder Mr. Wang, I’d love to share my observations along the way and my thoughts on why it is a super great opportunity.

Business

SharkNinja is a leading small household appliance company in the US (79% of total sales) and UK (13%), and it’s rapidly expanding in Europe continent (4%) in recent years, too. The company owns two brands: Shark in cleaning appliance and beauty (55% of the sales) and Ninja in kitchen appliance (45%).

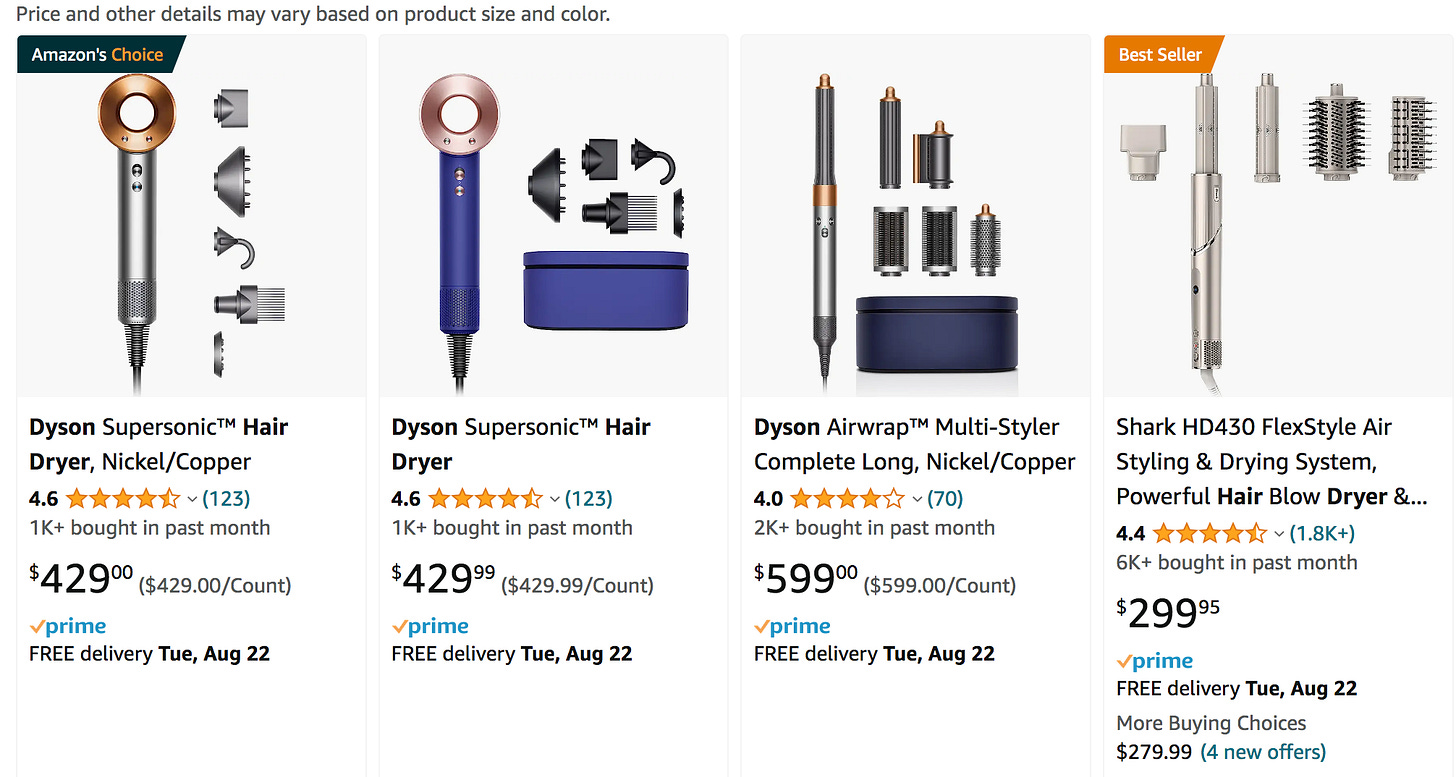

Both of the two brands focus on mid-to-high end market. Its value proposition is you have the $100 entry level products brands, and you have $400 super fancy products brands such as Dyson. But the middle is kind of a white space. So SN tries to give you a big Wow by using their creativity and supply chain capability to offer the fancy products at $200. By doing that, SN can capture the most of the market.

A good example is Shark’s Flex Style. It combines hair dryer and styler in one at just $299, compared with Dyson’s $429 hair dryer and $599 styler. You can find the Amazon links below. Shark gets a 4.4 rating while the Dyson products get 4.6 and 4.0. Also I’ve attached a comparison video from Youtube which I find quite objective. Dyson does offer some better small features and designs, but they are mostly comparable. BTW if you check the comments below, people do think Shark’s much more affordable price is a huge advantage.

Shark and Amazon Hairstyle tools on Amazon:

Shark and Dyson comparison on Youtube by Milabu and comments:

You can see from the Amazon excerpt that Shark is the bestseller. No wonder SharkNinja has been taking market share consistently and swiftly.

Competitive advantage

Honestly I do not rate SharkNinja as A+ in terms of business model. Household appliance industry is competitive and the players have to try very hard to stay in front. However, it is not the worst business either. We can easily find some brands with a history of 50 or even 100 years. The peer group’s 3-year average ROE was 16%, which is above average. Overtime, the brand goodwill and scale become some sort of moats. The important thing is SN has built an infrastructure to stay ahead in innovation and its economy of scale guarantees its advantages in supply chain, marketing and retailer shelf space.

When I interviewed the company, competitors and suppliers, I asked them what SN’s biggest advantage was. The answers I got were very consistent- its ability of fast innovation. SN has a 700-people R&D team across US, UK and China so they can keep innovating 24/7. They have an SOP to identify customers’ pain points, roll out prototypes, collect feedback and make adjustments. Their culture remains start-up-like so they work faster and more diligently than their big-corp peers. Also with the help of JS, I have to say Chinese people are very diligent and creative in terms of functional innovations, SN’s R&D capability has been greatly enhanced. As a result, they can roll out new products in 6-12 months while it takes competitors 2-3 years. Even when I read the customer comments, when the customers find something about SN’s products is not perfect, they are pretty confident and full of expectation that SN will have a new, better version soon.

Some of SN’s innovative technologies (I strongly suggest you to try them. They look really cool!):

For the scale advantage, one of its smaller competitors revealed that SN was more capable of locking down suppliers’ capacity and had more resource for marketing during the COVID supply chain shock. Furthermore, SN has a full spectrum of channel including online retailers, brick and mortar, and DTC, so they are well balanced and not restrained by a single retailer.

In conclusion, SN is an A+ company with structural moats in a B-grade industry. Not the best business in the world, but it still deserves a decent multiple, isn’t it?

Growth opportunities

SN has a three-leg growth strategy:

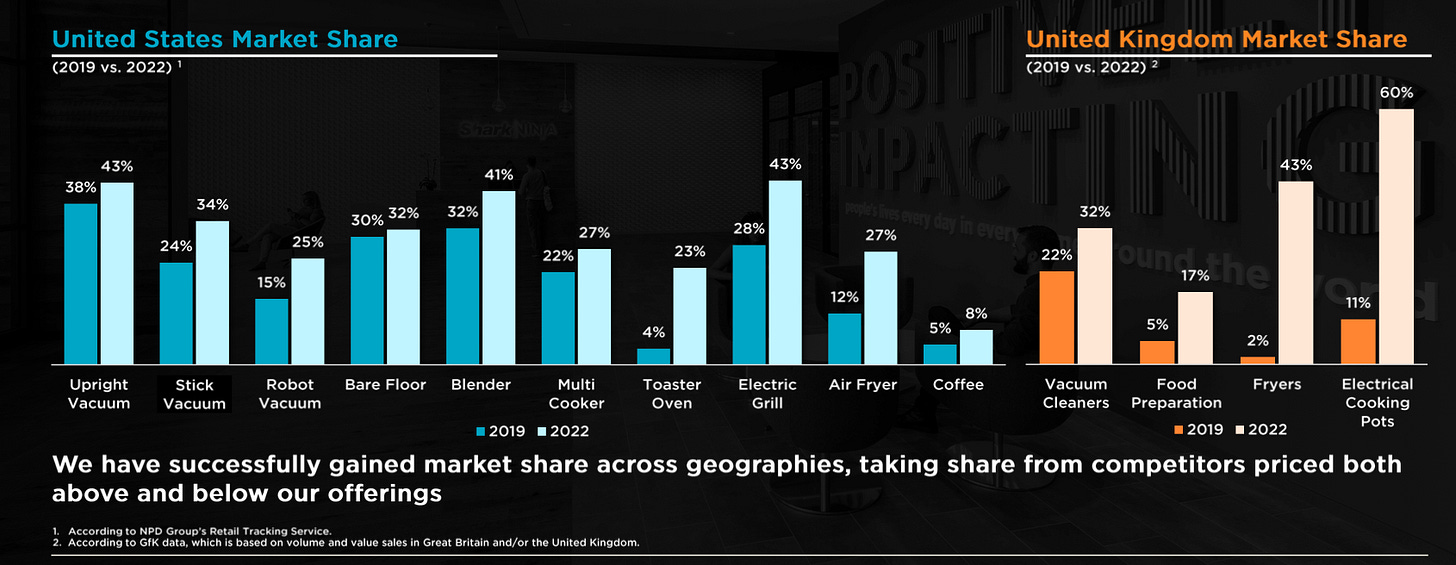

To grow share in existing categories

To enter adjacent and new categories

To enter new geographies

According to SN’s prospectus, their international TAM is $112bn and their SAM is $39bn. And they are expected to grow at mid-to-high single digit. Given its $3.7bn revenue in 2022, it has captured c10% of the SAM. Are the TAM/SAM numbers legitimate? Your guess is as good as mine. And I don’t think it’s easy for SN to grow significantly in the vacuum category in the US. However, I’m convinced that SN’s creativity and attractive pricing would probably win it more revenue in new categories and geographies.

Take its ice cream machine Ninja Creami for example. It was a $50m dollar market before Ninja rolled out the gadget in 2021. But because the machine makes it so convenient for you to create your own ice cream treat in any flavor you could imagine with only $160, its annual sales surged to $150m, which means the market size more than tripled to $150-200m. That’s the power of innovation creating new demand. SN used to target at 30-50 year-old female customers, the Ninja Creami attracts female teenagers to the brand!

Here’s a comparison between Ninja Creami with a traditional ice creamer maker, which takes 2-3 days to make a batch of ice cream, by Tired Tested and True:

Ninja Creami Youtube comments:

Another cool item I find is the Ninja Woodfire, a portable grill perfect for apartment usage or RV trips at $300. Looks like a great deal to a middle-age male like me! Check out the review below. If you don’t like the stock, you may still want to try one of those lovely products. You are welcome!

Ninja Woodfire Youtube review by Kenna’s Kitchen:

I bet SN’s creativity has legs for its financial statements. Moving on to geographical expansion, they entered UK in 2014 and today it’s a $500m business. They started in UK with just Shark brand and in recent years they are introducing Ninja there. And since 2020, they are entering the Western Europe markets. With less than $300m in Europe continent, the room for future growth is huge.

Profitability Outlook

The COVID years were dramatic for many businesses, especially so for consumer discretionary. 2020 and 2021 was great years when the FED printed too much money and the supply was very tight. So both the growth and margin were superb then. But in 2022, things turned south as consumers became more conservative of their spending, retailers realized they had stocked too many inventories, and logistics were still disrupted, neither the growth nor the margin performed well.

Thanks to the contribution in Europe, SN was able to remain flat on the topline in 2022. But the GPM dropped from 45.5% in 2020 to 37.9%. So was the OPM from 16.9% to 8.6%. 2022 was really a low base margin-wise. The OPM could rebound to 10% or 12%+ in time. Also SN is making marketing investments in new regions and new categories. So when SN is more established in Europe or beauty or outdoor cooking categories, and when it grows larger in terms of revenue, I see further margin expansion opportunity.

As you see in the chart above, in 23Q1 we already saw some topline growth and margin recovery. What’s better, the management hinted ‘Q2 growth, topline strong and then even from a profitability level’.

Valuation

So we have a global industry leader, with ample room to grow, traded at 12-13x PE on a low-margin base. If the margin recovers well, SN has chance to double its 2022 net income in 2025 or 2026, which means 18-25% CAGR, or 0.5-0.7 PEG.

Furthermore, if you look at the peer comp, it’s more obvious that SN is absurdly undervalued.

Note: based on market data on Aug 17th, 2023. Except for Zojirushi, all the multiples are on adjusted basis.

To match up with the most undervalued peer, it should get an 18x PE. But as SN generates better margin, ROE, and growth than peers, it should deserve a bit more, maybe 25x? In my dream, 30x!

Note: SN’s 2020 growth rate was based on JS data with SN APAC, so the actual SN data could be different. SN 2022 ROE is on adjusted basis.

The Spin-off

You may wonder now why SN is so undervalued. Mostly it’s because SN is a newly spin-off from China. US investors does not know the company or the background of the spin-off well. Here are some observations support my argument:

I found no sellside coverage on SN so far. (I believe soon there would be, as the major banks were all at the IPO roadshow.)

There is no major institutional investor on the shareholder list. (I do see some names such as Black Rock and Dimensional, but I believe they have been here with JS in HK. And their ownership is well below 1%.)

When I talked with some US investors, they told me at the first glance most people would think it’s another pump-and-dump from China, which I believe is highly unlikely and will touch on it later.

Also I believe part of the reason is there are forced sellers and arbitrageurs from previous JS shareholder base, because:

The recent daily trading pattern is the stock price plunges in the morning session (which is the evening of China, when people here are still awake.), and picks up in the afternoon session when it is deep night in China. The arbitrage investors of JS would have made 30-40% by now so it’s reasonable for some of them to sell SN without considering the intrinsic value

Due to the capital control and mandates of many mutual/private funds in Mainland China, they cannot directly own assets in the US. So for those investors who bought JS through the HK-China Connect, the spin-off actually create a dilemma to them. Furthermore, as the HK-China Connect levies 20% dividend tax, the spin-off was not quite tax efficient for those shareholders either. That is why when the spin-off decision, a clear value-enhancing move, was disclosed in Feb 2023, the stock price plunged by 30%. Also sarcastically, the Chinese investment community (buyside and sellside) is so ignorant about capital allocation that if you ask them (or us) what spin-off is, most of them will have no idea. But it is great for us to harvest this clear arbitrage.

To solve the Connect investors’ problem, JS has created a Trust for those shareholders. The Trust will sell those shares within the first 90 days after listing, then return the cash to the Connect shareholders. So they are the forced sellers during these days. The Trust held 1.67% of total shares outstanding.

Now we know why SN is undervalued. But why did JS and Mr. Wang do the spin-off? It dated back to the history of JS acquired SN in 2017:

Mr. Wang Xuning is the founder of Joyoung Co. (SZ: 002242), which is the No.3 small household appliance company in China. Joyoung is a well-known brand in China with a $1.34bn annual revenue and $1.56bn mktcap. Back in 2017 Joyoung wanted to break into the international market. Mr. Wang hoped SN to be the global platform for Joyoung. And SN’s owner Mr. Mark Rosenzweig wanted to retire and find a home for his company. So the deal was made.

Yet soon Mr. Wang realized it was very difficult to for a Chinese brand to enter developed markets, either it was easy for SN to succeed in China. As a result, he made a very wise decision to leave SN independently and made SN’s CEO, Mr. Mark Barrocas, the CEO of JS’s global business. So Mr. Wang is very good at delegating and SN remained as a US company. What was better, Joyoung did help SN improved its supply chain (cheaper source in China, saving SN $50m a year), heating technology (that’s what Joyoung is great at. It was the key contributor to Ninja Foodi), and robot-navigation technology (with the acquisition of vSLAM, the key contributor to Shark Matrix). And SN’s revenue more than doubled after the acquisition.

In 2019, JS Global Lifestyle listed in HK Stock Exchange, with the 67% ownership of Joyoung Co. and 100% of SN. The stock performed so well until mid-2021, but then fell into crash mode for the you-know-what reason with HK market. In 2022 it was traded mostly at low teens PE, so finally Mr. Wang decided to spin off SN to list in the US, to its home.

For the reasons of the spin-off, in SN’s prospectus it says:

To strengthen the operational management ability of both JS and SN, and their abilities to recruit and retain personnel.

To enhance geographic focus of both JS and SN.

To improve the operation, financial transparency and corporate governance of both companies

To allow investors to assess the two separate businesses and select which one to invest in

I don’t disagree that all of the above reasons are legitimate. However, I can share with you an interesting anecdote. When we talked with Mr. Wang personally, he asked us a question of his own, ‘What if China did what Russia is doing to Ukraine someday?’ IMO, that is the more legitimate question (or answer). And I guess it keeps many Chinese entrepreneurs up in the night. The spin-off will give Mr. Wang an out.

Furthermore, the multiple gap between HK and US is so obvious. So it’s literately a no-brainer to bring SN home, isn’t it?

Corporate Governance

To my experience, a key factor to a successful arbitrage is the corporate governance. I suffered a lot mentally in the China Brilliance arbitrage. (Please see my previous China Brilliance write-up. All my concerns became true. Murphy’s Law!)

But for SN, thank God I don’t have a single concern in regards with corporate governance:

As far as I know, Mr. Wang is a respected businessman in China. And I’ve never heard about any tricky stories of Joyoung or JS.

I believe SEC and US legal system is a much stricter watchdog than their Chinese counterparties.

SN is the major source of wealth to Mr. Wang and his family out of China. For a Chinese who believe China could mess up, it is not wise to mess up Uncle Sam, right?

To my observation, JS and Mr. Wang’s capital allocation decisions were so wise and shareholder friendly!

On his capital allocation history, let me tell you more:

JS’s dividend payout ratio has been more than 50% since it IPOed.

JS promised to complete the spin-off by the end of 2023 at the first place. But they were so great to beat that schedule.

Because the market sentiment in the US was not the best this year, SN decided to go public without issuing a single share, so that shareholders won’t be diluted at such a bargain price.

When JS found the spin-off was so misunderstood in HK, they bought back $20m worth shares in June 2023, making them the 9th most share bought back company in HK.

Various insiders, including Mr. Wang, made public market acquisitions of JS share in 2022 and 2023.

It is such a happy experience for shareholders to have such a thoughtful management team, isn’t it?

At a first glance, SN is incorporated in Cayman with a Chinese man holding 57% of the shares. Very scary. I admit there are better corporate structures than that and hopefully it would improve overtime. But given that we are living in such a fast-changing time and the tight spin-off schedule, I would not ask for more.

On management incentive, CEO Mark Barrocas holds 1.3m shares, or 0.94% of total shares outstanding, Chief Commercial Officer Neil Shah holds 0.41%, and Chief Legal Officer Pedro J. Lopez-Baldrich holds 0.02%. I wish more of the management members could own more shares, in a decent way. No detailed management compensation is disclosed so far. But I believe $40m and $20m worth stock still mean something to Mark and Neil, right? BTW, even though Mark did not create SN, he is still considered one of the second-generation cofounders. I will give a founder-led company a bit more credit.

Catalysts

More sellside coverages (if there is any now)

More influential US investors (a bit more than I am) get involved

SN delivers good results in the next few quarters (the most recent one is on 24th Aug)

Forced sellers and arbitrageurs sell out their holdings (I estimate by today 60-70% of the free float have been turned over since the spin-off)

Risks

A big hit on the market overall sentiment so SN’s valuation won’t improve, but rather the peers’ valuation would converge with SN’s.

A bigger than expected macro downturn hits the demand.

Lower than expected progress in Europe market.

Extreme geopolitical conflicts cause supply chain shocks.

Last words in this write-up

My dear readers, if you have make it here, I guess my writing did not bore you and I hope you could join me in this investment, so we can help each other get richer!

If you still decide to stay out, you are more than welcome to try some of the cool products of SN, so that your life will get a bit happier and SN and my fellow shareholders will get a bit richer!

If you still decide to stay out of that, please subscribe to my channel and I’ll try to be more productive and offer you something better next time!

See you soon!

Disclaimer

This article is only for informational purposes and should not be considered as investment advice. I and/or the people I advise to hold investment positions in SN stock. I and/or the people I advise would not get a share of the proceeds from any SN products you would buy.

Wonderful writeup. Thanks for sharing mate.

A few questions on my end:

1. How is the company able to price its products so cheap vs peers? What's the differentiator in its value chain that allows it to do so?

2. The products it sells have a long replacement cycle so, the revenue is not recurring. From where do you believe the growth will come from - market share gains, cross-selling to existing customers etc.?

3. What's the customer acquisition strategy?

Thanks

Interesting... I will include in next Monday's "Emerging Market Links + The Week Ahead" post e.g. https://emergingmarketskeptic.substack.com/p/emerging-markets-week-august-28-2023