Marlowe Plc (Lon: MRL)- a fast growing buy-and-build compliance platform with 200% upside

Summary

Marlowe Plc is LSE AIM listed UK compliance company. It’s building a one-stop compliance service platform through buy-and-build strategy. It focuses on the fragmented, GBP 8bn+ UK compliance market with 5-10% market share in the various sub-sectors. The business is recurring in nature and counter-cyclical, as it provides non-discretionary, mission-critical service to enterprises. Through its one-stop model, Marlowe’s strategy is to grow organically at HSD through cross-sell and up-sell, while bolt-ons could contribute extra MSD to HSD topline growth.

Marlowe’s management and board of directors have sufficient skin in the game. Their compensations are strongly aligned with shareholders’ interests. The stock price needs to increase by 158% by Mar 2026 for the management to get bonuses. And the insiders have bought shares multiple times in 2022.

Marlowe’s fast-paced acquisitions, especially with several large ones in the last two years, have brought a lot of adjustments and restructurings, which confuses investors whether its business model is cash generative and sustainable. Especially so after H1 FY23 results and it led the share price to fell dramatically. I found the quality of its earnings has improved overtime and the one-time costs in H1 made sense. The company decided to cool acquisitions down for a while and focus on integration. Therefore, I believe its unadjusted margin and cash flow would improve in the next a few reporting periods.

With the adj. EBITDA margin expanding from 19% to 25%, Marlowe’ profits could keep growing at 20%. Its FY25 (Mar 2025) unadjusted EBITDA and PE are 6.4x and 15.6x, or 5.8x and 6.1x on adjusted basis. Marlowe’s peers are trading at 20-40x EV/EBITDA in private equity market. Given the non-cyclical nature of the business and long growth runway for consolidation, I believe Marlowe is significantly undervalued and see a 200%+ upside in two years.

Business Description

The chart below illustrates Marlowe’s business model- end-to-end compliance service: it starts with intelligence for customers to update changes of regulations by its consultants, informational software, as well as e-learning software; then follows with consultant services to help clients stay compliant; plus it offers software solutions such as Meridian to monitor and document clients compliance process; at last, Marlowe’s technicians go to clients’ sites for regular and on-demand inspections and repairs, lawyers provide employment legal services, and healthcare professionals take care of employee physical and mental health.

Marlowe divides its operation into two divisions: Governance, Risk and Compliance (GRC) and Testing, Inspection and Certification (TIC). The GRC side is more office-based and involves software and off-site elements, therefore generating higher margin. In comparison, TIC is field-based and generates lower margin. Marlowe started with Fire and Security in TIC in 2017. It entered GRC in 2019 and sets GRC as the main driver of its future blueprint.

Another important feature of Marlowe’s business is its high stickiness of customers: 85% of the revenue is recurring, such as software subscriptions and multi-year contracts. Its customer retention rate is 93% and average customer relationships is 12 years.

UK Compliance Market

Marlowe believes the total addressable market it involves in is more than GBP 8bn and Marlowe holds top position in these markets. It also thinks the TIC markets are growing at 2-3% and GRC are slightly faster, thanks to the growing public risk awareness, ESG campaign, insurance requirements, and digitalization of business compliance, etc.

Regarding to the exact market size, I don’t think anyone have an accurate answer. But my channel check confirms that it’s big, growing and fragmented. There are some helpful data points to understand the market:

- The demand is recurring. The regulations are constantly evolving, so enterprises and property owners should update their knowledge and practices with the changes. For example, the fire door safety check frequency would update to quarterly from annually in Jan 20231. And UK businesses could be required to formally assess terrorism risk from 20232.

- It’s mission-critical to customers. The cost of incompliance is high and proportional to the scale of the business. So the bigger you are, the bigger fine ticket you’ll get when you have a problem. According to Marlowe, the average health & safety fine in the UK increased 381% from 2018 to 2022.

- Good service is appreciated and there is a tendency of outsource to specialists. Under UK law, when there is a health & safety problem and it is taken to court, it is the accused who is responsible for proving it has provided adequate safety measures, instead of the prosecutor.

- It is in general recession-proof. Though some SME would cut costs on compliance, which is not wise, the larger customers usually would not do that. Marlowe mainly serve mid and large scale businesses.

- The market is fragmented. There is ample runway for Marlowe to consolidate. And Marlowe is the only consolidator.

- It’s not a super-fast-growing market, therefore it does not attract much outside capital and it’s a good fit for gradual consolidation.

Unit Economics

Marlowe targets to buy bolt-ons at a 6-8x pre-synergy EV/EBITDA multiple and aims to lower the multiple by 1x post synergy. For those ‘transformational’ acquisitions, the multiple would be higher, sometime higher than 10x. In H1 FY23, during which there were only bolt-ons, the average multiple was 6.8x. The ROE of the bolt-ons is sensitive to the entry multiple and leverage, which the target is 1.5-2.5x. Based on a 5% interest rate and 19% tax rate, the ROE of acquisitions looks like this:

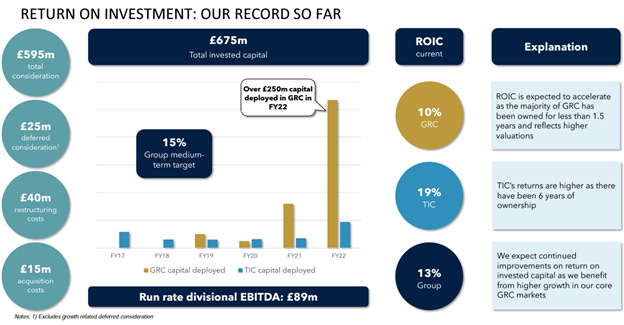

In its FY23 H1 presentation slides, Marlowe released its ROIC in different segments. The function is adj. EBITDA/total invested capital excluding earn-outs. The GRC and TIC segment achieved 10% and 19% respectively. The company attributed the lower ROIC for GRC to its shorter operating history, which is reasonable. Also I believe it’s a result of the higher multiples of GRC deals. I think it’s more appropriate to use after tax profit to calibrate ROI. Therefore, I’d give it a 20% discount. So 8% for GRC and 16% for TIC, which are not extremely lucrative, but surely create value for shareholders.

Growth: acquisitions and organic growth

In Feb 2021, Marlowe rolled out a 3-year group plan with three targets: 1. to grow revenue from 245m to 500m (run-rate basis) 2. to improve run rate EBITDA margin from 15% to 20% 3. to increase SaaS revenue contribution from 3% to 10% of the total group revenue. Marlowe is clearly ahead of its schedule. Marlowe would probably achieve the goal in FY24 H1. And the company thinks they don’t need further acquisitions, but just through organic growth and margin expansion to achieve the goal.

From 2019 to 2022, the revenue and adj. EBITDA has grown at 35% and 70%, although adj. EPS grew at a less attractive rate at 26%. The gap was due to Marlowe’s equity placements for its ‘transformational’ acquisitions in the last two years. We’ll cover this issue later.

Obviously, acquisitions are the main powerhouse of its growth. Marlowe has done 76 deals with GBP 640m since its founding in 2017. Its management team has rich experience in acquisitions and have built a decentralized corporate structure for roll-up strategy: the small head office focus on M&As, while the 6 business units focus on operation and integration of the acquired businesses. According to some former employees, the central M&A team is highly efficient and the process is streamlined, which is shown by its increasing acquisition pace and the fact that more than 80% of the deals were self-sourced.

It’s worth noting that after the GBP 138m acquisition of Optima Health in Jan 2022, the management decided to slow down a bit to integrate the major acquisitions. I think it’s the right strategy as: 1. the acquisition have been a bit too aggressive in the previous two years and there must be some integration focus needed. 2. Marlowe’s big deals have been funded through shareholder diluting placements and brought large restructuring costs and therefore profit adjustments. It’s better for them to prove to the capital market that they can deliver solid unajusted profits and cash flows. 3. in this QT environment, it’s no longer wise to leverage the balance sheet for acquisitions.

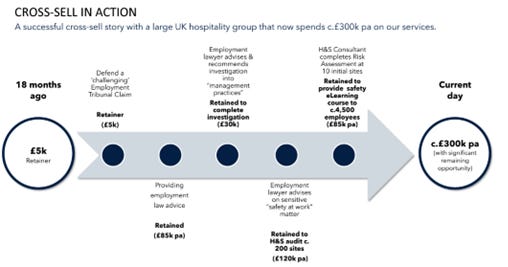

Another driver is organic growth. Marlowe believes it has and will continue to deliver 7-9% organic growth through upsell and cross-sell. The rationale is the decision maker of a client is usually the same person for its various services, and customers can simplify the supply chain and enjoy better data service. According to my primary research, this one-stop concept particularly adds value to smaller clients. In this way, Marlowe could save costs on sales and marketing, as well as improving technician utilization through higher route density. A good example is it has developed a GBP 5k account to a GBP 300k one in 18 months, by providing employment law advice, audits, and e-learning services. Companywide, the revenue contribution from clients taking multiple services has grown from 20% in 2019 to 40% in 2022.

Yet Marlowe exaggerated its organic growth in FY2021 (Apr 2020- Mar 2021). I confirmed with the company that the 7% growth in FY21 was their guestimaion in case there were no COVID-impact. But the growth was not specifically mentioned in its FY21 report except for ‘an 8% like-for-like decline in revenues during the first half’ and ‘recovered strongly in the second half with growth of 15% compared to H1’. Based on my experience, this kind of dodge usually means the actual figure is not as good as expected, usually negative. It is reasonable the business was negatively affected by COVID, especially the on-site TIC services. Based on my back tests, the underlying business declined by 6% in FY21 and rebounded by 12% in FY22. I really wish the company had just reported what it is instead of making such adjustments.

Margin expansion is another driver for profit growth. In the past years, Marlowe’s profitability has been steadily improving, by adding in higher-margin GRC businesses and integrating the business through cross-sell, route density, etc. The evidence is the adj. EBITDA margin of the TIC segment compared with the group margin before 2020, when there was little GRC. Its goal for FY24 adj EBITDA margin is 20%. And the management think they can further improve to reach 25%.

I believe the margin improvement is attributed to the integration and synergies Marlowe has brought in. The bolt-ons would be absorbed into one of Marlowe’s six platforms, double-running infrastructure and roles are rationalized, certain cost inputs are procured centrally or get insourced, each technician can serve more clients thanks to route density, and smaller companies could take advantage of Marlowe’s proprietary software which they cannot afford as stand-alone companies.

Profit adjustments and cash flow

The integration has brought quite a few restructuring costs in the first 12-18 months after the acquisitions. Therefore, Marlowe reported a lot of adjustments in the income statements, which makes investors suspect if the company is really profitable. The majority of the adjustments fall into three categories: restructuring costs, acquisition costs, and amortization of acquired intangibles. The good sign is the adjustments as a % of adj. EBITDA has been falling steadily over the years. Based on my forecasts, if there’s no more transformational acquisitions, 90% of adj. EBITDA will fall through reported EBITDA in FY24 & 25, which means the quality of the profitability could significantly improve.

Based on historical data, we do see some economy of scale in those adjustments. A series of deals made acquisition costs surge in FY21 & 22. But as there were no major acquisitions in H1 FY23, the acquisition costs fell significantly. In H1 FY23, it was reasonable that the restructuring costs increased due to the integration of the GBP 138m acquisition of Optima Health in Jan 2022. These are all evidence of management’s claim that the adjustments are one-time in nature.

Is the amortization of acquisitions a fair adjustment? I think so. Marlowe’s argument is it’s a non-cash item. But I believe the fundamental reason is that the intangibles from acquisitions had been expensed but rather capitalized before the acquisitions. If we assume the accounting policy stays consistent post acquisitions, those intangibles would be replenished through expenses, not capex. Therefore, amortizing them would lead to double counting the expenses. Below is an illustration by the book The Serial Acquirer Primer of Gustaf Hakansson, which shows if the intangibles are amortized, the profit and therefore the value of the business would be unfairly underestimated.

Therefore, whether Marlowe’s management is creating or destroying value is determined whether they have paid the right price for the intangibles and goodwill. The profitability of the underlying business should not be impacted by amortizations. So I agree that the adj. EBIT and adj. EPS are a better reflection of the value of the underlying businesses.

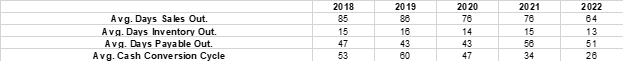

Marlowe’s cash flow has been improving over the years too. Cash conversion cycle has improved from 53 days in FY18 to 26 days in FY22. Also the adj OCF/adj EBITDA increased from 44% in FY18 to 83% in FY21&22 (as the FY21 was positively tilted by COVID subsidies). Assuming that ratio to be 80-85% from FY23 to FY25, Marlowe could generate enough cash to keep on 15-20% topline growth with bolt-on acquisitions.

Some challenges Marlowe’s lack of cash generation and reliance on outside capital to fund its acquisitions. Yet in its FY annual report, for the first time in history, Marlowe said ‘As a result of our significant operating cash flows, we are able to fund bolt-on acquisitions via cash generated from the business, rather than relying on external financing.’ Though the company said they would still seek equity financing for transformational deals in the future, but not on a valuation like this.

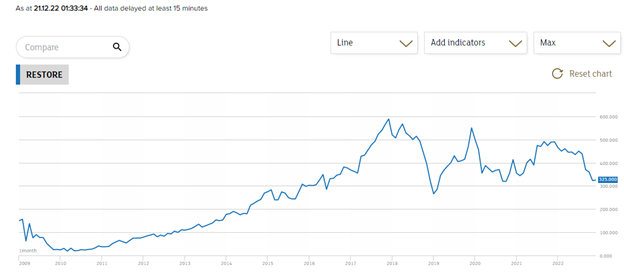

Management and incentives

Marlowe’s key executives are from another buy-and-build type of company, Restore Plc. The CEO Alex Dacre was its Head of M&A from 2010 to 2013. The CFO Adam Councell was its CFO from 2012 to 2019. And the Non-executive Director Charles Skinner was its CEO from 2009 to 2019. And both Restore and Marlowe are backed by UK Conservative Party treasurer, Lord Ashcroft. Based on Restore’s stock price chart, it was a successful venture under their reign. It’s also interesting that Marlowe’s CTO Peter Bell, who joined in Jan 2021, had worked for the roll-up legend Constellation Software for more than 12 years.

Alex Dacre, the CEO and founder, is a restless and charming entrepreneur in his mid-30s3. His father is a prominent figure in UK- Paul Dacre, the editor-in-chief of the Daily Mail. No wonder he is so well-connected in the business world. In 2015, with the support of Lord Ashcroft, he started Marlowe with his personal wealth of GBP 2m. He has built the decentralized architecture of Marlowe, with the industry veterans running the business units, while he manages capital allocation and M&As with a bunch of youngsters. He described Marlowe’s culture as ‘entrepreneurial autonomy’.

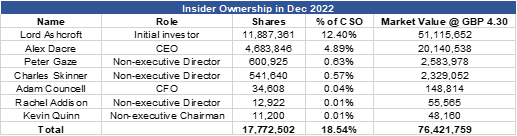

If we count Lord Ashcroft as an insider, though he is not involved in the operations or the Board, the total insider ownership is 18.54%. It’s a reasonable guess that his stake in Marlowe accounts for the majority of Alex Dacre’s net worth, given his young age and relatively short working experience before Marlowe. For some other executives and directors, though Marlowe is not their major net worth, I believe they have sufficient skin in the game.

In 2022, several insiders have bought shares multiple times. Though I wish they could have bought more, it’s a good sign of they see value in the stock price. Since Marlowe’s establishment, these insiders have not sold any shares, except for Alex Dacre and Charles Skinner sold GBP 3.4m and 2.3m worth of shares in Mar 2021 through the oversubscribed equity placement.

Marlowe’s CEO and CFO only received modest compensation compared with peers. In fact, the upside of their compensation is through the 2021 Executive Incentive Plan, through which they can receive 10% of the total shareholder return above GBP 11.11 per share in Mar 2026, at a maximum of 4.9m shares, or 5% of total shares outstanding. The downside of Plan is that share price is impacted by many factors out of management’s control, which could be frustrating to them when stock price falls with the market. Yet I appreciate this Plan as it has a very long duration to offset some of those short-term factors and it ties the management’s interests with shareholders. At GBP 4.30 per share today, it means the share price has to appreciate by c160% in a bit more than three years for them to get a bonus.

What I wish the management to improve is their capital allocation decision. Their priority is to build scale or the platform, so it’s very likely they would seek more equity financing for ‘transformational’ acquisitions, though they can self-fund the bolt-ons. And their target leverage is a bit conservative at 1.5-2.5x, though the business is defensive in nature. I have suggested they do share repurchases to take advantage of the low share price, but they prefer to do acquisitions and repay debt. The good thing is they are not likely to issue shares below GBP 10, the placing price they did in early 2022.

Valuation and upside

Based on the assumptions that

1) 3% annual organic growth from FY23 to FY25

2) 18%, 19% and 20% adj. EBITDA margin from FY23 to FY25

3) GBP 60m, 80m and 80m bolt-on acquisitions each year from FY23 to FY25 and no transformational acquisitions

4) moderate acquisition and restructuring costs accordingly to smaller scale acquisitions

Marlowe would be traded at 5.8x EV/adj. EBITDA and 6.1x adj. PE. If 3% organic growth and 80m bolt-ons would sustain, its EBITDA and adj. PE would continue to grow at 20-25%. Therefore, I believe the current stock price is significantly undervalued. If Marlowe could deliver moderate growth and improved unadjusted metrics, I see the opportunity to reevaluate to 20x, or 200%+ upside in 3 years.

I don’t find a perfect comparable company for Marlowe. There are several GRC comparable companies being acquired: Alcumus, a UK based EHS service provider with 18% revenue growth and 36% EBITDA margin in 20204, was acquired for 17x EBITDA in early 20225. Another buy-and-build regulatory and compliance software company, Ideagen Plc, was taking private at 15.4x EV/Sales or 44x adj. EBITDA for GBP 1.09bn in May 20226. The size of these deals really dwarfs Marlowe’s market valuation. If we put a 15x to Marlowe’s GRC run-rate EBITDA, the segment would be worth GBP 750m. Put a 10x EV/adj EBITDA to its TIC business, that will sum up to a GBP 1.1bn EV, or 125% upside to the equity. The current low valuation could easily make Marlowe a target for acquisitions by private equity firms.

Risks

1. The thesis is based on Marlowe’s delivery of higher quality, less adjusted and more cash generative financials. If Marlowe fails to deliver, it’ll disappoint the market. Furthermore, as a 2B service company, there’s no alternative data to track its operation, and the company only reports twice a year. Thus, the period of silent waiting could be quite painful. It takes patience and faith in the management. Since it’s a show-me story, I suggest building positions gradually, keeping a regular dialogue with the company, and moving accordingly to the results.

2. My thesis tries to figure out Marlowe’s economics and value assuming no transformational acquisitions, which could muddy the income statement, make significant change to the balance sheet and bring dilution. Also large acquisitions could bring extra integration risk to the company. I’ve heard from some former employees who deem some of its integrations to be unpleasant and challenge Marlowe’s strategy. I understand people would have a different point of view from different standpoints, and changes are not always pleasant. But it’s a risk.

3. UK economy looks quite gloomy these years. Inflation, unstable political environment, and strikes, volatile Sterling, etc. A worse than expected macro environment and social turmoil could seriously affect Marlowe’s business.

Disclaimer

This article is only for informational purposes and should not be considered as investment advice. Marlowe is a small cap UK AIM listed stock and can bear significant risks. The information in this article is solely my personal opinion and can be subjected to errors. Please do your own due diligence. I personally don’t hold any work position in Marlowe Plc. I and/or the people I advise to hold investment positions in Marlowe’s stock.

https://www.gov.uk/government/publications/fire-safety-england-regulations-2022/fact-sheet-fire-doors-regulation-10#fn:1

https://worknest.com/blog/martyns-law-businesses-could-be-required-to-formally-assess-terrorism-risk-from-2023/

https://www.thetimes.co.uk/article/alex-dacre-dont-sleep-on-marlowe-as-the-next-big-thing-to-break-into-the-ftse-100-fr83dfl7n

https://reorg.com/inflexion-prepares-for-alcumus-sale/

https://www.penews.com/articles/inflexion-and-apax-shake-hands-in-600m-deal-for-alcumus-20220211

https://www.reuters.com/business/uks-ideagen-agrees-13-bln-buyout-offer-2022-05-09/

Great pitch ! Agree - this looks very interesting. Have you gathered any incremental information good / bad since posting this that you think is worth mentioning? Have your views on the stock changed at all?

I would suggest that you don't take the numbers that the management put out in its financial literature and run some of your own analysis. Adjusted Net Income and Adjusted EBITDA are simply ways for the management to say "We don't want you to look at this and we don't want you to look at that. Ignore the ugly numbers and everything looks just rosy!"

The share count is increasing at a rate of over 30% CAGR. That means that shareholders are being diluted by approximately 25% every year. So the value of the business needs to increase by that amount merely to keep your head above water as an investor (very few companies grow at that rate sustainably).

Top line revenue is growing, but it is all acquired sales. Anyone can buy another company and bolt on its sales. The trick is getting it at the right price so that it is accretive for shareholders. Return on invested capital in real terms is negative and getting worse. Asset turnover is in decline. Leverage is increasing. Net CAPEX is running at well over 150% of gross profit. Stock based compensation is more than 7x net income (so the management are taking out more than the business is producing).

Am I missing something here?

You say in your article "Alex Dacre... manages capital allocation and M&As with a bunch of youngsters"

I think that sums it up nicely. Perhaps its time to hand the management over to the adults!