Company Overview

Rome Capital is a privately owned investment management firm. Our strategy focuses on special situations and small/mid-cap growth compounder investments in North American and European exchanges. Our firm was founded in 2023 by Alex Feng and Jason Quan, MBA graduates and classmates from Columbia Business School.

Investment Team

Alex Feng: Alex serves as the Chief Investment Officer of Rome Capital. Prior to Rome Capital, Alex was a Senior Analyst at First Manhattan First Beijing Co., where he covered stocks in multiple industries and regions. Alex has over 10 years of experience in stock research and portfolio management. Alex earned his MBA degree from Columbia Business School’s Value Investing Program, and holds an Master in Finance from Peking University, and bachelor’s degrees in Finance and Russian Literature from Beijing Foreign Studies University.

Jason Quan: Jason is the Head of Research of Rome Capital. Prior to Rome Capital, Jason worked as a management consultant at Kearney, where he gained extensive experience across various industries and functions. Before Kearney, Jason accumulated industry experience at Meituan and Kuaishou in Beijing, and at Dow Chemical in Philadelphia. Jason holds an MBA degree focusing on value investing from Columbia Business School and a bachelor’s degree in Industrial Engineering from the University of Michigan.

Letter of Chief Investment Officer

January 25th, 2025

Dear friends,

We are delighted to share our first Annual Report with the public! 2024 was a transformational year for Rome Capital as we streamlined our strategy, portfolio, and operations. Since this is our first report - and there were so many changes - this letter might be a bit long and (hopefully not) boring.

For you, this is a chance to get to know us better and maybe even borrow a few ideas (Come on, join the feast! We all do this!). For us, it’s a logbook of two young (yes, still!) men venturing into a world that the other 1.4 billion folks back home probably wouldn’t choose to explore.

Whether we make it or not, Jason and I will have something to be proud of - looking back 40 or 50 years from now and rereading this first chapter of the journey. We have only got one life to live. So far, it has been a blast! Hop on and join the fun—it is just getting started!

Our Strategy

A strategy should consist of two elements: the goal and the path.

What is our goal?

Our goal is to generate exceptional long-term returns for our partners and ourselves through investments in equities and derivatives. A good and sharp allocator friend once concluded: there are only two types of funds will survive in the future– big, autopilot index funds and small, smart hedge funds. We aim to be the latter.

If history repeats itself (but who really knows?), an investor could achieve a 13% annual return1 by simply investing in the S&P 500 index - or probably even better if you focus on just 7 of the 500. We’re aiming much higher, of course - though over the long term, not year by year. That’s the level we aspire to reach.

How are we going to achieve that goal?

We don’t choose the M7 Highway2 - highways rarely lead to the peak. Instead, we prefer secret trails that take us to high elevations with extraordinary views. These backcountry paths are often less crowded - or even completely empty (few sell-side analysts or institutional investors cover them). They can be risky, but they also offer the potential for high rewards.

Another way our investment strategy resembles mountaineering is that we take the bottom-up approach. (You’ve probably figured out I’m not a fan of skiing or skydiving.) Everything starts with the fundamentals of each stock: business model, market position, competitive advantages, growth potential, management incentives, valuation - you name it.

We’re drawn to two types of paths in particular. What they have in common is that we aim to turn the disadvantages of large institutions into opportunities for ourselves. They are:

Small- and mid-cap growth: Great companies all start from small. We focus on finding those young champions, analyzing their fundamentals, engaging with industry experts, and growing alongside them. Large institutions often fish in different waters due to liquidity constraints, giving us an edge to become the most knowledgeable investors in these companies. Once we discover them, we’re comfortable holding on for a very long time. For this strategy, our investment universe would be companies in Western countries.

Special situations: We define special situations as instances where significant changes occur in a company's capital structure or shareholder base. Classic special situations include spinoffs, bankruptcy emergences, merger arbitrages, asset sales, large share buybacks, insider buying, and more. In many cases, stock pricing becomes highly inefficient due to forced or indifferent selling, often by large institutions. This is where we leverage our behavioral edge to capitalize on these opportunities. Compared to our first strategy, we can be nimbler with special situations, sometimes prioritizing high internal rates of return (IRRs) over absolute returns. Different to the first strategy, we may take positions in Chinese companies for special situations because the value realization schedule is clear and shorter.

Portfolio management strategies: Our portfolio typically consists of around 10 long positions with relatively uniform distribution: a good idea gets 10%, a high-conviction idea 15%, and a riskier one 5%. We believe this approach suits us best at this stage, as over-diversification could dilute returns and exceed our management capacity. While this concentrated portfolio may experience greater volatility, we’re willing to accept it in exchange of long-term high returns. At the same time, we employ hedging strategies to help manage and control those risks.

2024 in Review

Portfolio performance

While 2024 was a year of strategic refinement and repositioning, we are proud to have delivered value for our partners and remain highly confident in the resilience and long-term strength of our approach. We have shared our performance directly with our existing partners, and we welcome potential limited partners to reach out for more details. While we understand the temptation to focus on a single year's results, we encourage a longer-term perspective—particularly for 2024. This was a year of transition, with an entirely new set of positions that require time to fully play out. Additionally, in the second half of the year, we implemented significant adjustments (read as 'improvements/upgrades/refinements') to our portfolio management strategy, positioning us for stronger and more sustainable performance over the long term.

Therefore, we believe it's helpful to walk through our portfolio companies as well as some closed positions to help you understand how we invest. You can find them in the Portfolio Update section. In this letter, we'd love to share some of our key learnings from 2024:

Hedging: With a portfolio more concentrated than most funds, it’s crucial to hedge the key risks of our top holdings. Among the past mistakes we’ve made, we don’t believe we’ve chosen the wrong companies— actually most have outperformed their peers. However, if we had been more active and strategic with hedging, our results could have been significantly better. By leveraging options, we can both enhance returns and manage risks. This is an area where we have a lot to learn and improve in the coming years.

Good and bad spinoffs: Spinoffs remain a great strategy, but not all spinoffs are created equal. In the case of GiG, the spinoff didn’t resolve its liquidity problem (for details, please refer to the Portfolio Update section). Our key takeaway so far is that successful spinoffs often arise from significant differences between the SpinCo and RemainCo, such as scale, industry, geography, or exchange listings. Going forward, we’ll focus on checking these boxes for future ideas and improving our pattern recognition.

Timing of special situations: The success with SharkNinja gave us more confidence than we should have. Corporate actions take time to play out, and the market isn’t always as efficient as we might expect. In some cases, we acted too quickly and should have exercised more patience.

Engagement with management: When a stock or business doesn’t perform as expected, we should and will engage more actively with the management team to work toward better outcomes for shareholders. It’s a skill we’re continuing to develop through practice.

Market observations

Recently, we've heard a steady chorus of investors lamenting the difficulty of finding attractive opportunities. As I write this, a quick check of the Value Investors Club shows that 72% of members claim to be finding few bargain-priced stocks. Interestingly, this sentiment has been constant since I first started monitoring it back in mid-2022. Then S&P had two phenomenal years. After all, value investors didn’t earn the reputation for being 'cheap' without reason.

The S&P 500 may appear elevated, with the Shiller PE ratio at 38.6x - second only to December 19993. However, it's important to note that M7, which now account for over 30% of the index, are trading at a 50% premium to the remaining 493 companies4. This disparity suggests that the broader market is not as expensive as the headline index might imply. More importantly, our approach is purely bottom-up, focused on identifying a select few compelling opportunities billions away from those S&P behemoths. Finding 10 attractive ideas remains well within our reach, even in this environment.

2025 Outlook

Looking forward, we expect more of our investment thesis would start to play out. Our focus would be to keep rebalancing the portfolio based on our strategy and to research on new ideas. In the future, we’ll regularly publish fund letters every quarter. They would be shorter and more concise to discuss updates of the portfolio.

We genuinely wish all our readers, partners, and ourselves a happy and prosperous 2025. We look forward to catching up again in early Q2.

Alex Feng

Chief Investment Officer

Portfolio Update

Portfolio overview

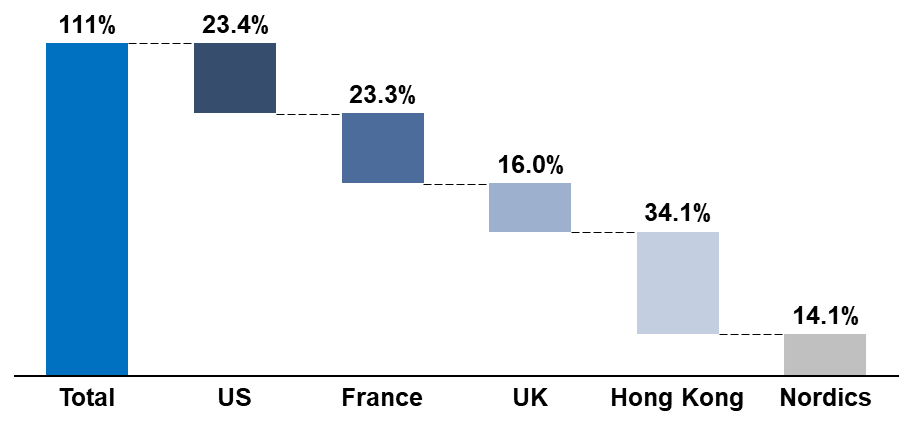

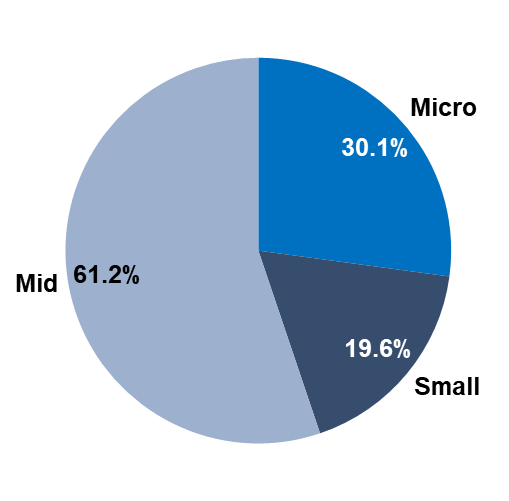

The following charts show an overview of the portfolio on December 31st, 2024. We had 9 long and 1 short positions in the portfolio. Below we break them down by listing regions, market cap, and strategies:

Breakdown by Listing Regions

Breakdown by Market Cap

Breakdown by Strategies

We would like to highlight the following points for our readers:

Temporary Leverage: Temporary leverage may occur during portfolio rebalancing. However, it is not our intention to maintain leverage for extended periods.

Options Strategy: We utilize options both to enhance returns and for hedging purposes. For this reason, some of the actual positions are larger than the numbers show. We maintain our option positions at a controlled and limited scale.

Stock Count vs. Positions: The number of individual stocks may exceed the number of investment positions, as we sometimes use multiple stocks to express a single investment thesis.

Portfolio Rebalancing: The portfolio has not yet reached its optimal structure, as we are currently in the midst of a rebalancing process.

Current positions

We will discuss the individual positions in alphabetical order:

Brilliance China (1114 HK)

Brilliance China represents a special situation opportunity, where the market has priced in the bear case scenario, yet there are multiple potential catalysts for us to capitalize on. Since our Substack write-up in Oct 2022, the stock has been a multi-bagger, driven by several rounds of special dividends. (I confess, we only captured one of those and sold.) Nonetheless, due to the recently announced regular dividend policy, we still find it highly attractive today.

Valued at 19 billion HKD now, the company has a 25% ownership stake in BMW China with 8 billion HKD cash on balance sheet. What caught our attention again was the December 17, 2024, announcement that Brilliance China would pay out at least 50% of its future net income as regular dividends. Additionally, the company’s investor relations team indicated plans to distribute most of the 8 billion HKD cash as a special dividend. Given their excellent track record in 2023 and 2024, we find this guidance highly credible.

At less than 6x P/E, the market appears to assume a collapse in BMW China's profitability. While concerns about intense competition, BMW's slower EV and smart UI adoption, and the operating leverage of automakers are valid, the implied scenario—net profit dropping from 34 billion HKD in 2023 to 6 billion HKD annually5—seems overly pessimistic. Our differentiated view is that BMW’s brand equity remains strong among Chinese consumers: a BMW still delivers better impressions on a date or in a business meeting than a Li Auto or Huawei.

We believe the bigger risk lies in the deteriorating consumptions on discretionary by Chinese consumers. To hedge this, our strategy includes building a short position in Macau casino operators, as the income of BMW buyers is likely correlated with the spending power of Macau gamblers.

On the upside, the stock could easily appreciate by 50% if positive developments occur, such as BMW China delivering 10 billion+ HKD in net profit, more market exits by domestic competitors, a special dividend announcement, or a regular dividend exceeding 50%. Importantly, more than one of these catalysts could materialize.

Cake Box (CBOX LN)

Cake Box is the leading cake shop chain in the UK, with approximately 250 stores compared to just 20–30 stores for its two closest competitors. Operating under a franchise model, Cake Box manages its network exceptionally well. This model enables the company to remain capital-light, highly profitable, and scalable.

Cake Box leverages its scale advantages in marketing, product development, and sourcing. These advantages, in turn, make it more attractive to franchisees than its competitors, allowing Cake Box to secure prime locations and establish itself as the go-to brand in new markets. As a result, Cake Box is targeting the opening of 25–30 new stores annually—equivalent to the size of its competitors' entire networks.

The business is super durable - after all, everyone has a birthday every year. Even better, the growth runway is highly promising. With its current 250 stores covering only one-third of the UK population, we see no reason why Cake Box can't double its store count domestically. Additionally, same-store sales are likely to improve as the stores mature. What’s even more exciting is Cake Box’s planned expansion into Ireland and Continental Europe in 2025. And that’s just the top line. On the bottom line, Cake Box is now poised to pull the operating lever, having completed its investments in central functions and entering a new growth phase. As a result, we estimate Cake Box can deliver 20%+ net profit growth over the next few years.

Cake Box is currently trading at a very undemanding 15x P/E with a 5.2% dividend yield. As an under covered micro-cap stock, its recent investments in central functions have temporarily masked its true profitability. The market has punished these improvements, which we believe should ultimately be rewarded.

Our direct engagement with customers and franchisees has further strengthened our confidence in the business. Once Cake Box demonstrates its growth potential and successfully executes its international expansion, we believe the stock has the potential to become a multi-bagger.

Edenred (EDEN FR)/Pluxee (PLX FR)

Edenred and Pluxee dominate the global employee benefits market with a combined 60% share—40% and 20% respectively—focused primarily on Continental Europe and LATAM. Their core business involves issuing meal voucher cards to corporate employees, which can be used for dining at restaurants or purchasing food at supermarkets.

These programs are popular with employers and employees because governments provide tax breaks on such expenditures. In return, Edenred and Pluxee earn a 5% cut on the gross consumption volumes. What’s even better, employers prepay for the cards, allowing the issuers to accumulate a growing float balance and generate investment income from it.

In short, this business operates like Visa or American Express. (Yes, one of Warren Buffett’s punch card ideas) Even without new business, revenue organically grows with inflation. The network effect is powerful—more merchants attract more clients, and vice versa—making it extremely difficult for new players to enter the market. Looking ahead, we believe Edenred and Pluxee are well-positioned to deliver double-digit growth, driven by increasing benefit amounts and new types of benefits offered by employers, supported by favorable government policies.

We first discovered Pluxee when it was spun off from Sodexo in early 2024. At the time, it traded at a significant discount to Edenred (11x vs. 13x EV/EBITDA). However, in less than a year, Edenred’s stock price halved, and its multiple contracted to 8x due to an RFP investigation and a potential regulatory change in Italy. (Sounds familiar? Think American Express) As collateral damage, Pluxee’s multiple also shrank to 9x, despite Italy accounting for only 3% of its revenue.

Edenred is still lobbying and suing for the Italian incidents, so they may not necessarily have a negative outcome. Even if they do, the impact is limited to just 10% of Edenred’s EBITDA. However, the market appears to be pricing in a scenario where these issues spill over into other countries, which we view as overly pessimistic. Meanwhile, both Edenred and Pluxee have guided for low double-digit EBITDA growth in 2025, underscoring the resilience of their business models.

This was another major drag on our performance in 2024. That said, we’re pleased we correctly identified Pluxee’s valuation discount, and our holding in Pluxee outperformed the industry. The Italian incidents were more of an unexpected misfortune—or perhaps a fortunate turn, as the current prices present a compelling opportunity, particularly for Edenred.

If Edenred continues to execute or if any of the regulatory issues are resolved, we see a strong rerating potential for the stock. Pluxee also offers upside, albeit on a smaller scale. Edenred’s 8% shareholder returns from dividends and share buybacks providing solid support, and the upside is particularly attractive.

Gentoo Media (G2M OB)

Gentoo is the world’s second-largest online gaming affiliate. In plain English, it owns a portfolio of websites and bids for Google keywords to help online casinos acquire players, earning a cut from the players’ future losses. Gentoo emerged as the RemainCo from the Gaming Innovation Group (GiG) spinoff and was rebranded under its current name.

The company first caught our attention in Q1, driven by the spinoff. We shared our research on Substack as well. While it didn’t turn out to be a winner for us, it did outperform the number-one player, Better Collective (BETCO OB), whose stock dropped 49% in 2024.

In hindsight, we were correct in our belief that GiG had the right strategy of focusing on Europe and being selective in M&A. Also we believe they were right to spin off the loss-making Platform business. . However, we were wrong to think the spinoff would trigger a significant stock price rally. In fact, its limited liquidity remains a challenge, and the stock was further impacted by the sector-wide meltdown.

However, the stock is now trading at 5-6x EBITDA, and management reported 20-30% growth in Q4. The key strengths of its fundamentals remain intact. Insiders have continued to buy shares whenever possible, and the largest shareholder has publicly hinted to go private if the stock doesn't perform. We believe that in 2025, Gentoo will become more active in paying dividends and repurchasing shares. We expect these actions, along with strong results, to act as meaningful catalysts for the stock.

NCR Atleos (NATL US)

NCR is the world’s leading ATM manufacturer, owning a 35% share of the global market. The company was spun off from NCR Corp in late 2023.

Atleos is currently trading at 6.5x EV/EBITDA, a valuation that may initially seem justified for an OEM combined with ATM. However, Atleos is far more than a traditional hardware manufacturer. Over 70% of its revenue—and an even greater proportion of its profits—are recurring, derived from software, machine maintenance, and transaction processing.

More importantly, Atleos is transitioning from selling and maintaining ATMs to managing ATMs for banks, a model known as ATM-as-a-Service (ATMaaS). This shift represents a significant industry trend. While ATMs remain essential to banks, they are not profit centers and are costly to manage internally. For Atleos, ATMaaS not only generates higher recurring revenue but also increases revenue per machine by 2.5x over its lifecycle.

Banks benefit as well, saving 25–35% of total costs by outsourcing ATM operations. ATMaaS providers, in turn, gain efficiency through scale and density advantages in managing networks. Given these dynamics, we believe the majority of the world’s ATMs will eventually be outsourced, with Atleos uniquely positioned to lead this transformation.

Under NCR Corp, Atleos was underinvested as the previous management prioritized the retail segment. As a standalone company, Atleos can now allocate its resources more effectively toward its ATMaaS initiatives. This represents a multi-year growth story, with management guiding for double-digit growth. If executed successfully, Atleos has the potential to become another multi-bagger opportunity.

REV Group (REVG US)

REV Group is a North American leader in specialty vehicle (SV, fire trucks and ambulances) manufacturing, operating in an oligopolistic industry with high barriers to entry and stable demand driven by replacement cycles. About 74% of pro forma 2024 revenue comes from SV, which enjoys strong customer loyalty. The company also produces recreational vehicles (RV), a more cyclical segment.

Before 2023, under its largest shareholder (a PE firm), REV Group pursued bolt-on acquisitions that expanded its business and market share but suffered from poor M&A integration and pandemic-induced supply chain disruptions. These challenges weighed heavily on EBITDA margins.

A Blessing in Disguise: The pandemic brought unexpected opportunities for REV Group. Supply chain disruptions resulted in a robust three-year backlog for its specialty vehicles. Simultaneously, rising inflation and increased municipal budgets allowed REV Group to implement aggressive price increases for those backlogs, with pricing 30-40% higher compared to pre-pandemic levels in 2019.

A Turnaround Story: In 2023, the private equity investor began exiting its stake, allowing new leadership to drive a transformation. The team implemented operational improvements, strategic pricing, and divested non-core assets, resulting in adjusted EBITDA margins improving from 3.7% in fiscal Q1 2023 to 8.3% in fiscal Q4 2024. This progress lifted the stock price from low teens to $31.87 by year-end 2024.

We initiated our position in Q2 2024 but significantly increased it following the stock price crash on the day of the Q3 2024 earnings, resulting in an average purchase price of $24 per share. The market overreacted to a topline miss in the RV segment while bluntly ignoring the continued improvement in SV EBITDA margins, which generated substantial cash flow.

We believe REV Group is on track to achieve management’s goal of a 10-12% adjusted EBITDA margin by fiscal 2027. The company's unique competitive position, anchored by a 2.5-year specialty vehicle backlog and a superb leadership team, positions it to deliver solid results and significant long-term value for shareholders. We believe REV Group should trade at 8x EV/EBITDA by 2027. Currently, it is trading at $34.8 per share, reflecting a 5.8x forward 2027 EBITDA multiple. This represents a modest 38% EV upside over the next three years. We will continue to monitor its progress closely and adjust the position as it approaches the target price.

Samsonite (1910 HK)

Samsonite is the undisputed global leader in the luggage industry, distinguished by its unmatched global scale. Its three major brands—American Tourister, Samsonite, and Tumi—span the market from entry-level to luxury segments, creating a comprehensive product portfolio. With a 15%+ ROE, our research indicates that Samsonite will maintain its competitive edge through branding and scale advantages. Over the long term, we expect the company to deliver GDP-plus growth in mature markets like North America and achieve accelerated growth in underpenetrated regions such as Europe, South Asia, and LATAM.

What truly caught our attention is Samsonite's plan to pursue a dual listing in the U.S. Currently, Samsonite trades at approximately 12x 2024 P/E in Hong Kong. In contrast, U.S.-listed consumer discretionary brands with comparable scale, growth, and profitability—such as Columbia Sportswear, Tapestry, and Under Armour—trade at valuations ranging from 15x to 30x P/E. We believe a dual listing in its home market has the potential to eliminate this valuation discount.

Unfortunately, Samsonite was a detractor in our portfolio for 2024. While we were aware of the macro slowdown risk—which unfortunately materialized—we made two missteps. First, we overestimated the timeline for the dual listing, influenced by the typically faster execution seen with Chinese companies. Second, we over-weighted Samsonite in our portfolio, a decision driven both by our expectation of the dual listing and by the more concentrated portfolio strategy we implemented earlier in the year.

As we look ahead, we finally see some silver linings. Samsonite's sales growth has been picking up in recent months, its share buybacks are enhancing shareholder value, and the dual listing is likely to take place in 2025. Whether U.S. investors value the company at 15x or 20x P/E, we are confident it will trade at a significantly higher multiple than in Hong Kong.

Our plan moving forward includes three key actions:

Engage with the management to accelerate the dual listing process and improve shareholder communication.

Continue right-sizing the position in line with our established portfolio strategy.

Identify effective ways to hedge against macroeconomic slowdown risks.

Seaport Entertainment Group (SEG US)

Seaport Entertainment, a spin-off from Howard Hughes Holdings, launched at the end of July 2024. This represents a classic special situation, characterized by a spin-off with a right offering, management overhaul, and a turnaround opportunity. Seaport owns a portfolio of high-quality, strategically located assets in New York City and Las Vegas. Despite the prime locations and scarcity value of these assets, the company is currently highly undervalued relative to its potential.

Historically, Seaport suffered from operational mismanagement due to a mismatch in leadership capabilities, further exacerbated by the pandemic’s impact on urban tourism and real estate. However, with Pershing Square Holdings as its activist shareholder, owning 39.5% of the company, a transformative change is underway. Pershing Square has installed an exceptional management team led by Anton Nikodemus, a former Senior Vice President at MGM Group, with a proven track record in unlocking value from premier assets.

Our in-depth field research into Seaport's properties underscores its significant upside potential. While substantial turnaround work remains, we project a doubling of Seaport's current valuation over the next three years. Key catalysts include the monetization of non-core assets, targeted cost reductions, and strategic operational improvements — all of which are already in motion.

New positions

A leading US casino operator

In early 2025, we initiated a position in a leading U.S. gaming operator. The land-based gaming sector has faced valuation pressure due to economic uncertainty, high financial and operating leverage, and tough year-over-year comparisons. These challenges created a compelling investment opportunity.

The company has reached an inflection point and is positioned to generate over $1 billion free cash flow from a capex cliff and non-core asset sales, enabling accelerated debt reduction and share buybacks. Furthermore, it stands to benefit from a 20%+ digital gaming growth momentum, which is expected to contribute another annual $400–500 million EBITDA by 2026 — a factor largely overlooked by the market.

We anticipate its current share price could more than double within the next 2–3 years, driven by aggressive deleveraging and digital gaming growth. Further details on this investment and our thesis will be shared in the Q1 report.

A US offshore oil and gas company

Another new position is a SPAC that went public in 2024. The company has acquired three offshore oil platforms, along with the associated pipelines and processing facilities on the California coast. While the project appears promising and the company has stated that it has secured all necessary federal and state permits, the start was delayed again in late 2024 due to opposition from a county agency. Negotiations between the two parties are ongoing.

If the outcome favors the company, the stock could surge by 50% in a short period. Conversely, an unfavorable resolution would likely result in a significant decline. While we believe the company is more likely to succeed, the situation carries substantial long-tail risk. To navigate this, we have employed a hedging strategy to capitalize on the opportunity while mitigating downside exposure.

Existed positions

Capri (CPRI US)

Merger arbitrage is not a core strategy for Rome Capital, as we believe such opportunities typically offer limited upside with significant downside risk if a transaction fails.

In Q2 2024, however, we identified an intriguing exception: Tapestry’s (owner of Coach) proposed $57-per-share acquisition of Capri, an underperforming luxury conglomerate owning brands like Michael Kors, Versace, and Jimmy Choo. The Federal Trade Commission blocked the transaction in April 2024 over antitrust concerns, pushing Capri’s stock price to the mid-$30s and creating a 60% upside opportunity.

Our team conducted a detailed analysis, engaging with Tapestry’s management and consulting the U.S. antitrust experts. We concluded that Tapestry had a good chance of prevailing in the preliminary injunction hearing against the FTC, while Capri’s short-term downside risk appeared manageable at $25-$30. Based on this, we initiated a low single-digit percentage position using a mix of stock and call options.

To most people’s surprise, on October 24, a federal judge ruled in favor of the FTC. Capri’s stock fell to $20s, and our call options expired worthless. We exited the stock position shortly thereafter.

If we were to revisit this investment, we would enhance our approach by employing an options strangle strategy. Whether Tapestry/Capri or the FTC prevailed, this would allow us to profit on one side of the trade while mitigating risk on the other. While merger arbitrage is not a core focus for us, we remain open to pursuing future opportunities where a particularly attractive spread exists.

Emerging markets equity positions

We exited our legacy emerging markets positions in Eastern and Middle Europe and Southeast Asia—not due to a lack of confidence in the stocks themselves, but because we recognized our limitations in effectively researching and investing in these regions. Factors such as language barriers, information asymmetry, less developed regulatory environments, and a lack of local expertise made it challenging for us to compete. This decision was also a key step in the strategic transformation we outlined earlier.

Midea Real Estate Holding (3990 HK)

This was a classic asset-sale special situation—a unique and fast-moving investment. We entered and exited a 10% position within two days, generating a 9% return on our investment. The implied IRR speaks for itself.

Midea Real Estate was a mid-sized Chinese homebuilder. On June 23, 2024, the company announced the sale of its development business for HKD 5.9 per share, a 57% premium to the prior day's closing price. Post-sale, the RemainCo focuses on property management, a stable, cash-generating unit with a lot publicly listed peers in Hong Kong.

We did not foresee the asset sale in advance. However, based on the announced sale price, schedule, and a conservative valuation of the RemainCo using peer multiples, we estimated the stock's fair value to be between HKD 7 and 7.5 upon the announcement. Despite the significant premium, the market offered a price range of HKD 6 to 6.5, representing a 25–40% IRR. We saw this as an attractive opportunity, given the low transaction risk: the controlling shareholder Midea Group is a highly reputable corporation (the world’s largest AC manufacturer), and the terms of the deal were favorable for other shareholders to agree on. The position exceeded our expectations, as the stock rebounded to HKD 7 the following day.

Although we typically seek investments with a duration of at least one year, we are willing to pull the trigger when the market presents an unequivocal, high-conviction opportunity.

SharkNinja (SN US)

We achieved a 110% return on this investment over 18 months. Our Substack post in Aug 2023 not only solidified our reputation but also shaped our fund’s strategy. We exited the position between the $50s and $90s.

In hindsight, we wish we had been more patient, but this remains a textbook case study: forced selling by constrained institutional investors, highly motivated insiders, and a well-run company misunderstood by a new investor base. We leveraged our understanding of Chinese entrepreneurs to seize the opportunity but still underestimated just how generous the U.S. stock market can be.

The SharkNinja investment was extraordinary—one of our most successful "punch card" investments and a rare, once-in-a-lifetime opportunity. It also served as a classic example of the effectiveness of Greenblatt's spinoff strategy. While such an exceptional start might have created the impression that special situation investing is easier than it is (a lesson we’ve since learned), it reinforces our commitment to identifying similarly compelling opportunities in the future.

Company Update

General operations

In 2024, we streamlined and enhanced our research and monitoring processes and optimized team capacity allocation. A new digital infrastructure was implemented to add new databases, and improve data management, documentation, and communication across the firm.

Our official website and WeChat public account launched in the second half of 2024, alongside continued publication of selected stock research reports on Rome Capital’s Substack. These platforms enable us to selectively share investment ideas and invite feedback from interested investors and audiences.

Recruiting

In Q4 2024, we introduced the Research Analyst Mentorship Program, an 8–10 week intense in-semester internship designed to mentor students who are interested in fundamental equity research. The purpose of the program is to train passionate students to conduct primary research and help us gain more insight into the companies. To date, we have mentored six students from top business schools, including Columbia Business School, London Business School, INSEAD and ESSEC Business School. This program will continue in 2025, and we look forward to welcoming more talented students.

Media exposure

We were honored to present our Samsonite investment thesis on the Yet Another Value Investing Podcast on YouTube. Additionally, we were invited by LIONS Academy, a value investing institute in China, to share our special situations approach and present case studies.

2025 plan

We will further optimize our idea-sourcing strategy in the first half of 2025 to enhance the efficiency of idea screening. This initiative is expected to accelerate new idea screening.

Rome Capital is planning a stock pitch competition focused on small-cap and special situations investments at a leading U.S. business school. Additional details will be disclosed as logistics are finalized.

In April 2025, we will participate as speakers at the Greater China Society Investment Panel at Columbia Business School and host a fireside chat session at Columbia University. We invite all interested parties to attend these events.

Conclusion

We are highly optimistic about our current portfolio and remain committed to building a "smart" fund that delivers exceptional long-term returns through a focus on small- and mid-cap growth stocks and special situations.

We are open to sharing selected investment ideas through public channels and welcome inquiries from interested investors. For more information about Rome Capital, please contact us at afeng@romecapital.ltd or jquan@romecapital.ltd.

Alex Feng

Chief Investment Officer

and

Jason Quan

Head of Research

Disclaimer

The information in this report is Rome Capital’s opinion and may be subjected to errors. We may change our opinion without notice. We hold some of the stocks mentioned in the report. Our opinion is not investment advice. Please do your own due diligence and consult your advisors before making any investment decisions.

The net 10-year annualized return from iShares S&P 500 Index Fund by Sep 30, 2024 was 12.6%

The Magnificent 7: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla

https://www.multpl.com/shiller-pe

In December 2024, S&P 493’s fwd PE was 19.8x while M7’s was 30.8x, per Citigroup

Based on another special dividend and 6% yield on regular dividends

Thanks for your article Alex, how do your guys balance between growth and special situations? It looks to me that the two strategies have different durations.