Samsonite (1910 HK)- another homecoming queen

a systemetical way to profit from the US-China decoupling!

My dear readers,

It’s been a long-time. Hope you have had a great investment journey in the past year! Thank God I have, with the several special situation opportunities I have written about. Last year’s experience has converted me from a Buffett-style investor to a Greenblatt-believer. Brilliance China have more than tripled (sadly I’ve missed most of it. It was so disgusting). And Shark Ninja just hit my target price $60 yesterday (probably there’s still some upside, but not a lot).

If you missed those two great investments, don’t worry. I’ve got more to come. Today I’ll write about Samsonite with a few bullet points, as I read the longer a pitch is, the less likely it’s a good opportunity.

The setup is Samsonite, the Massachusetts-based and Luxembourg-incorporated world’s luggage leader, went IPO in Hong Kong in 2011 following the trend ‘getting closer to your valued customers’. TBH I don’t get it at all, in my 10-year experience as a Chinese Hong Kong Stock Exchange analyst, I’ve never bumped into anyone who follows or invests in it (neither in Prada, L'Occitane or my beloved Uniqlo).

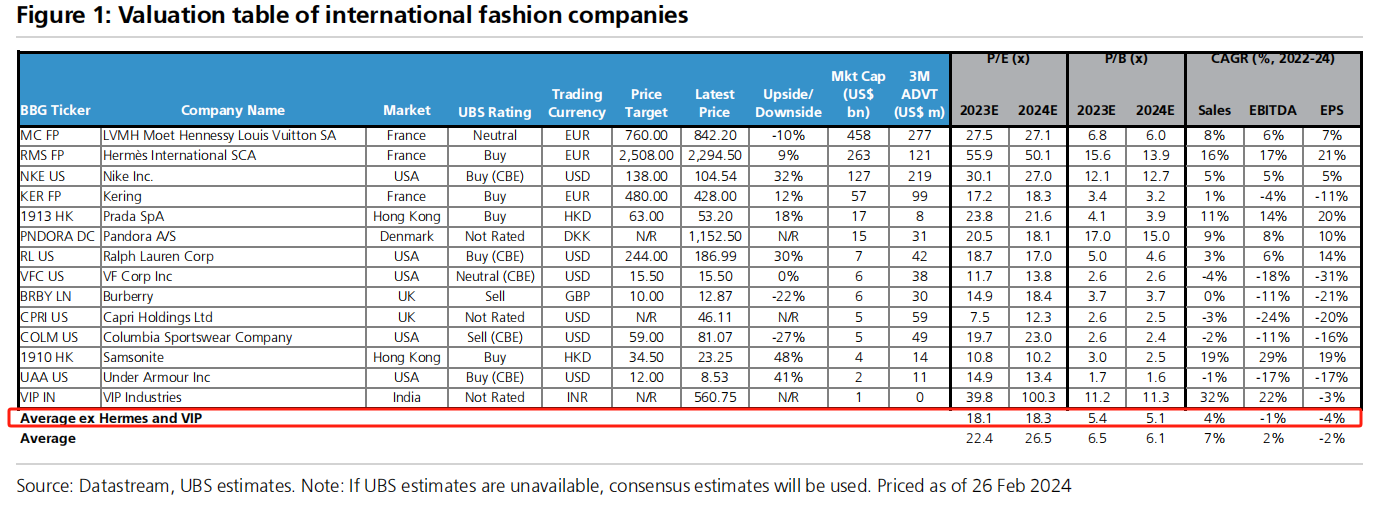

Though being an orphan, the results in the first years was not bad, trading over 20x PE for the most of the time (stock price went from HKD 9-ish at IPO to HKD 37 in 2018). Yet since then the Tumi acquisition kind of messed up, it opened too many inefficient stores in the good old days, then came COVID, and my dear home country decided to go against the civilized world. Samsonite has become a collateral damage and its HK listing is now a liability. Even though the company has executed a very successful turnaround in the past 3 years and the stock performace seems great since COVID low (from 6 HKD to 28), it’s still trading at huge discount at 12x 2024 PE. Now the management and insiders finally had enough and calls for a dual listing to where it should belong to (US or Europe), as they announced the decision earlier today.

Oops I’ve written too much. Here are the bullets I have promised you:

Samsonite is the sole luggage leader in the world, with 15% market share and a world-renown brand portfolio consists of Samonite, Tumi, American Tourister, Gregory, etc. Other than Rimowa and the special product line of those super luxury fancy brands, the market is just Samsonite and a bunch of cheap unbranded products. (TBH I don’t care about the brand of my luggage at all, but my wife bought two Samsonites last year. Perhaps that explains why the market structure looks like that. Yet I don’t mind to buy a Samsonite or Rimowa if I don’t have to pay my kids’ tuition. LV? My Uniqlo tee shouts Nooooo!) Conclusion: it’s definitely an above-average business with some branding moat (80-90% GPM on direct sales) and 15% ROIC in the long run, with good momentum.

COVID actually was a blessing to Samsonite. Besides many smaller competitors were washed out, Samsonite was able to close 300 underperforming stores (from c1,300 to c1,000), streamlined the functions, and saved $200m expenses annually. Unit store performance is higher than ever according to channel check. Net profit margin has rebounded from 3.6% in 2019 to 11.3% in 2023 (FYI, the pre-COVID peak was 9.6% in 2017). The company is now opening new stores again and expects to deliver low double digit growth in the coming years. Conclusion: the business is healthier than ever.

The management expressed the stock performance in HK was acceptable pre COVID and US-China tension, the multiple was good though the liquidity could be better. But now they are complaining HKSE has become an orphan market since the decoupling: they made the turnaround, the sellside analysts know it and publish reports on it, but no buyside in HK gives a f**k. Actually the world’s capital is fleeing HK and will continue to do so (Example: as I’m writing this, US Congress is proposing to end the tax breaks for Chinese stocks.) So the management started to consider a dual listing since 2023H2 and now they finally made the decision. Conclusion: the company is going to move.

The management team is on the same boat with the shareholders. The Chairman owns 4.2% of the stock outstanding, or $218m. The CEO owns 2.12% or $110m. Plus, the duo own 28.8m options and other employees own 63.3m. I think they should give some care to the stock price, right? Conclusion: if you win, the insiders win, and vice versa.

Dual listing is the most efficient way to realize the stock value. It’s not difficult to imagine this US company would trade at 20x PE at home (or maybe even higher in Europe). My banker friend suggested dual listing in the US would take 1-2 quarters after the first filing. I expect another 2 quarters for the market to discover it. So around 12 month in total. If the interest rate can get lower, maybe we’d get 25x. I expect the 2024 net income to be $440-450m. The current mktcap is $5.3bn. Conclusion: I’ll leave the math to you.

The insiders have proven their care to shareholders through real actions. There have been rumors on Feb 27th that someone is going to take Samsonite private. So the stock price jumped from 23-ish to 27-ish in a day. I’ve been concerned in the past three weeks that it was MBO (I don’t expect the leverage buyer would be so generous to offer a 20x PE bid so it’d be a zero-sum game with the insiders). But today’s announcement ruled out the MBO nor the Board is interested in any privatization offer. As I said, dual listing is time efficient and can extract max value for shareholders. But for the privatization arbitrageur, they are out of this. (It’s really stupid IMO. The privatization rumor was merely a rumor all the way through.) That’s why the stock price collapsed from 31 HKD to 27 HKD today (forced sale alert). Actually it’s not a bad thing at all: the more depressed the stock is, the more frustrated the management is to get out of this shit pit. Conclusion: the insiders are acting in the most shareholder-friendly way and forced sellers today created a very good buying timing.

Risks?

What if the stock prices don’t converge on the two exchanges, as dual listed stocks are not fungible? The example I can find is the BGNE. It’s dual listed in US and HK and its stocks has been traded at parity overall. I can only prey arbitrageurs can find smart ways to take advantage of the disparity.

What if there’s another COVID or larger scale wars broke out? I don’ have a good answer, probably people would need strong luggage cases to flee? Just hedge with some healthcare and defense stocks if you worry about that.

What if the management become inefficient again, as they are opening more stores as they did before? It could be. But I heard the company structure now is different than before. For example, in the past they simply put American Tourister products into Samsonite stores, but the salepeople had no incentive to sell the AT products as they are of lower price and margin. But now AT is managed seperately and the store efficiency is much better. So I’m not worry about it at this stage. But in the long term, it can come back. You know the large corporates.

Ok. That’s the short-version thesis. I’ll write a shorter version disclaimer:

I hold interests in Samsonite stock.

Please do your own work. This is not an investment advice.

If you’d like to pay me for investment advice, you are more than welcome!

Loved the write up and your writing style Alex! Succinct and straight to the point. None of that sell-side BS haha

Thx Alex - we featured your excellent article in our Weekly Newsletter --> https://278773.seu2.cleverreach.com/m/15570577